You are here:iutback shop > block

The History of Bitcoin Price Collapses

iutback shop2024-09-20 23:24:42【block】0people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the first and most well-known cryptocurrency, has experienced several significant price col airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the first and most well-known cryptocurrency, has experienced several significant price col

Bitcoin, the first and most well-known cryptocurrency, has experienced several significant price collapses since its inception in 2009. These collapses have been a source of both excitement and concern for investors and enthusiasts alike. In this article, we will delve into the history of Bitcoin price collapses, examining the factors that contributed to these dramatic drops and the lessons learned from each event.

The first major Bitcoin price collapse occurred in 2011. At the time, Bitcoin was trading at around $1 per coin. However, by the end of the year, the price had plummeted to just $0.30. This collapse was primarily due to a combination of factors, including a lack of understanding of the cryptocurrency market, regulatory concerns, and a general lack of trust in the new technology.

The second significant Bitcoin price collapse took place in 2013. During this period, Bitcoin reached an all-time high of nearly $1,200 before plummeting to around $200 within a few months. This collapse was attributed to a variety of factors, including regulatory scrutiny, media hype, and speculative trading. The sudden influx of new investors, many of whom were looking to make a quick profit, contributed to the rapid rise in price, which was unsustainable in the long term.

The third major Bitcoin price collapse occurred in 2017. At the height of the cryptocurrency boom, Bitcoin reached an all-time high of nearly $20,000. However, by the end of the year, the price had dropped to around $3,200. This collapse was caused by a combination of regulatory actions, market manipulation, and a general loss of confidence in the cryptocurrency market. The collapse was further exacerbated by the emergence of numerous fraudulent ICOs and the subsequent loss of investor trust.

Each of these Bitcoin price collapses has provided valuable lessons for investors and enthusiasts. Firstly, it is important to understand that the cryptocurrency market is highly volatile and unpredictable. While Bitcoin has the potential to become a mainstream currency, it is not immune to the same market forces that affect other financial assets.

Secondly, it is crucial to conduct thorough research before investing in Bitcoin or any other cryptocurrency. This includes understanding the technology behind the cryptocurrency, the team behind the project, and the regulatory environment in which it operates. Investing without doing your due diligence can lead to significant losses.

Lastly, it is essential to maintain a long-term perspective when investing in Bitcoin. While the cryptocurrency market has experienced several dramatic price swings, it is important to remember that Bitcoin has the potential to become a valuable asset over the long term. Investors who are able to stay focused on their long-term goals and avoid panic selling during price crashes are more likely to succeed.

In conclusion, the history of Bitcoin price collapses is a testament to the volatility and unpredictability of the cryptocurrency market. While these collapses have been a source of concern for many, they have also provided valuable lessons for investors and enthusiasts. By understanding the factors that contribute to these collapses and maintaining a long-term perspective, investors can navigate the cryptocurrency market with greater confidence and success.

This article address:https://www.iutback.com/eth/78b56799354.html

Like!(25)

Related Posts

- Bitcoin Price Prediction Using Python Code: A Comprehensive Guide

- What is Driving Bitcoin Price Today?

- Buy Bitcoins in Canada: A Comprehensive Guide

- When Will Shib Be Listed on Binance: A Comprehensive Guide

- Binance Community Coin Round 5: A New Era of Blockchain Innovation

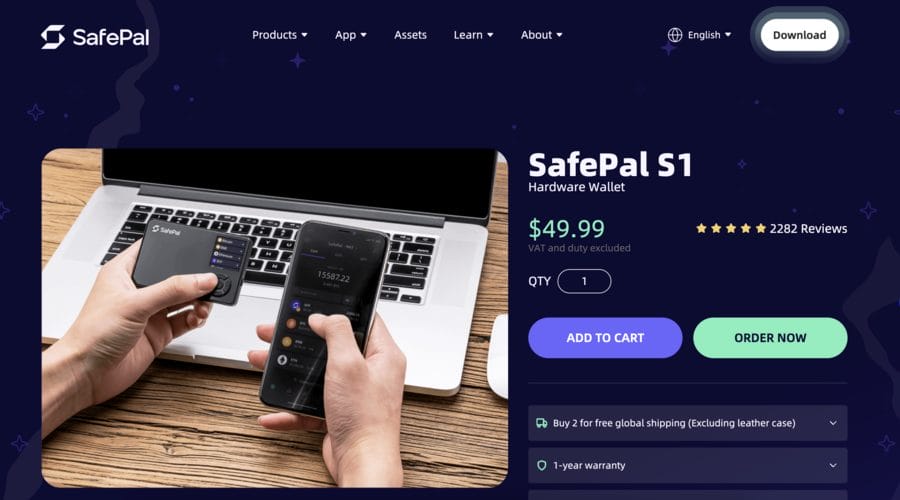

- The Safest Bitcoin Wallet for iPhone: A Comprehensive Guide

- Unlocking the Potential of Free Bitcoin GPU Mining Cloud: Bitcoin Mining Earn Online

- How to Get Bitcoins from Coinbase to Wallet: A Step-by-Step Guide

- How to Send Bitcoin on Cash App in 2024

- Bitcoin Price Will Reach 1 Million: A Comprehensive Analysis

Popular

Recent

Bitcoin Price Early 2017: A Look Back at the Cryptocurrency's Rapid Rise

**The Advantages of Solo Mining Bitcoin with GPU

How to Block Bitcoin Mining: A Comprehensive Guide

Wing Binance Listing: A Game-Changer for the Crypto Community

Bitcoin Mining Sweatshop: The Hidden Reality Behind Cryptocurrency

Bitcoin Price Prediction for February 2021: What to Expect?

Binance Leverage Trading Fees: Understanding the Costs and Benefits

Binance App Password: The Ultimate Guide to Protecting Your Crypto Assets

links

- The Historical Price of Bitcoin in India: A Journey Through Time

- Title: Unleashing the Power of Bitcoin Mining with Bitcoin Mining Software for Kali Linux

- Do You Get Taxed for Mining Bitcoin?

- Binance, one of the largest cryptocurrency exchanges in the world, has been a significant player in the blockchain industry. With its robust platform and wide range of trading pairs, Binance has become a go-to destination for many cryptocurrency enthusiasts. One of the most popular trading pairs on Binance is BNB/ETH, which has seen a surge in trading volume over the past few months. In this article, we will delve into the BNB/ETH trading pair on Binance and explore its potential for growth.

- Bitcoin: Are Wallets Nodes?

- Best Mining Equipment for Bitcoin: A Comprehensive Guide

- World Economic Forum Bitcoin Mining: A Comprehensive Analysis

- Que es la Binance Smart Chain: A Comprehensive Guide

- Bitcoin Mining Simulator Hack APK: The Ultimate Guide to Unleashing the Power of Cryptocurrency Mining

- Is It Safe to Keep Crypto in Binance?