You are here:iutback shop > price

Bitcoin Price Prediction Month by Month: A Comprehensive Analysis

iutback shop2024-09-21 01:55:52【price】2people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized digital currency, has been a topic of interest for investor airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized digital currency, has been a topic of interest for investor

Bitcoin, the world's first decentralized digital currency, has been a topic of interest for investors and enthusiasts alike. With its volatile nature and potential for high returns, many individuals are eager to predict its future price. In this article, we will delve into the concept of Bitcoin price prediction month by month, providing a comprehensive analysis of the factors that influence its value and the predictions made by various experts.

Bitcoin Price Prediction Month by Month: Understanding the Concept

Bitcoin price prediction month by month involves analyzing historical data, market trends, and various indicators to forecast the future value of Bitcoin. This approach allows investors to make informed decisions and adjust their strategies accordingly. By examining the price predictions for each month, we can gain insights into the potential fluctuations and trends that may impact Bitcoin's value.

Factors Influencing Bitcoin Price Prediction Month by Month

1. Market Supply and Demand: The supply and demand dynamics play a crucial role in determining Bitcoin's price. Factors such as the number of new Bitcoin being mined, the rate of adoption, and regulatory changes can significantly impact the supply and demand equation.

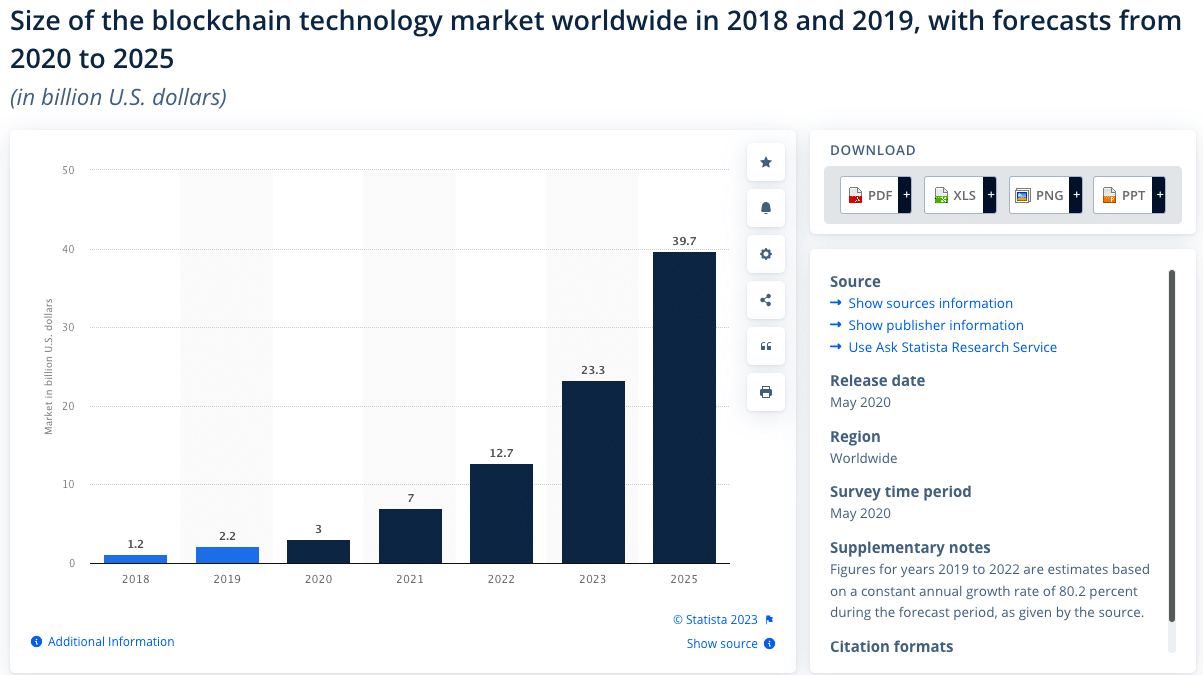

2. Technological Developments: Innovations in blockchain technology, such as the implementation of new protocols or the development of new applications, can influence Bitcoin's price. These advancements can attract more users and increase the demand for Bitcoin.

3. Economic Factors: Economic indicators, such as inflation rates, currency fluctuations, and global economic stability, can impact Bitcoin's price. For instance, during times of economic uncertainty, Bitcoin may act as a safe haven investment, leading to an increase in its value.

4. Regulatory Environment: The regulatory landscape surrounding cryptocurrencies can have a profound impact on Bitcoin's price. Governments' stance on cryptocurrencies, including regulations and bans, can influence investor confidence and the overall demand for Bitcoin.

Bitcoin Price Prediction Month by Month: Expert Opinions

Several experts have provided their predictions for Bitcoin's price month by month. Here are some notable predictions:

1. John McAfee, a renowned cybersecurity expert, has predicted that Bitcoin's price will reach $1 million by the end of 2021. He believes that the increasing adoption of cryptocurrencies and the potential for Bitcoin to become a global currency will drive its value.

2. Tim Draper, an early Bitcoin investor and venture capitalist, has predicted that Bitcoin's price will reach $250,000 by 2022. He argues that Bitcoin's scarcity and its potential to disrupt traditional financial systems will contribute to its rising value.

3. Blockchain Capital, a venture capital firm focused on cryptocurrencies, has predicted that Bitcoin's price will reach $50,000 by the end of 2021. They believe that the increasing institutional interest in Bitcoin and the growing adoption of blockchain technology will drive its price higher.

Conclusion

Bitcoin price prediction month by month is a complex task that involves analyzing various factors and expert opinions. While predictions can provide valuable insights, it is essential to approach them with caution. The volatile nature of Bitcoin means that its price can fluctuate significantly in a short period. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions based on price predictions.

This article address:https://www.iutback.com/eth/50b50799442.html

Like!(4168)

Related Posts

- Best Way for Mining Bitcoins: A Comprehensive Guide

- Can I Cancel My Bitcoin Transaction?

- How to Transfer Bitcoin to Apple Wallet: A Step-by-Step Guide

- How to Transfer Bitcoin Cash to Kraken: A Step-by-Step Guide

- What is happening to Bitcoin Cash?

- Binance Wings BTC: A Game-Changing Cryptocurrency Investment Platform

- Bitcoin Mining After That Is Gravy: The Future of Cryptocurrency

- Bitcoin Cash Timeline: A Comprehensive Overview

- Best Bitcoin Mining App 2017: A Comprehensive Review

- The Emergence of New Binance Smart Chain Tokens: A Game-Changer for the Crypto Ecosystem

Popular

Recent

FPGA Based Bitcoin Mining Free Circuit: A Comprehensive Guide

Pandoshi Binance Listing: A Milestone for the Cryptocurrency Community

Bitcoin Live Price in India: A Comprehensive Guide

Coinmama Bitcoin Cash: A Comprehensive Guide to Buying and Selling Bitcoin Cash on Coinmama

Bitcoin Price Prediction After the Halving: What to Expect?

Bitcoin Cash Overvalued: A Closer Look at the Cryptocurrency's Market Performance

Binance App: Safe or Not?

Can You Get Cash for Bitcoin?

links

- Can I Invest My Pension in Bitcoin?

- The Evolution of Bitcoin Cash to Bitcoin Exchange Rate: A Comprehensive Analysis

- Buy Bitcoin in Cash India: A Comprehensive Guide

- How to Withdraw BEP20 from Binance: A Step-by-Step Guide

- Binance Reef BTC: A New Era of Cryptocurrency Investment

- Swapping Bitcoin for BNB Trust Wallet: A Comprehensive Guide

- Binance Reef BTC: A New Era of Cryptocurrency Investment

- **Bonk Listing on Binance: A New Era for Crypto Enthusiasts

- Bitcoin Price Abbreviation: Understanding the Importance and Usage

- How to Import Private Key into iOS Bitcoin Wallet: A Comprehensive Guide