You are here:iutback shop > block

How to Turn Bitcoin into a Cash Bank Account: A Comprehensive Guide

iutback shop2024-09-21 01:35:15【block】6people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has emerged as a popular digital currency that has revolutionized the finan airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has emerged as a popular digital currency that has revolutionized the finan

In recent years, Bitcoin has emerged as a popular digital currency that has revolutionized the financial world. With its decentralized nature and potential for high returns, many individuals are looking to turn their Bitcoin into a cash bank account. This article will provide a comprehensive guide on how to do just that.

1. Understanding Bitcoin and its Value

Before diving into the process of converting Bitcoin into a cash bank account, it is crucial to have a clear understanding of Bitcoin and its value. Bitcoin is a digital currency that operates on a decentralized network called the blockchain. It is not controlled by any government or financial institution, making it a unique asset.

The value of Bitcoin is determined by supply and demand, and it can fluctuate significantly over time. It is important to note that Bitcoin is not a stable currency like the US dollar or the Euro. Its value can be volatile, which means it can increase or decrease rapidly.

2. Choosing a Bitcoin Exchange

To convert Bitcoin into a cash bank account, you will need to use a Bitcoin exchange. A Bitcoin exchange is a platform that allows users to buy, sell, and trade Bitcoin. There are numerous exchanges available, each with its own set of features and fees.

When choosing a Bitcoin exchange, consider the following factors:

- Reputation: Look for exchanges with a good reputation and a history of reliable service.

- Security: Ensure that the exchange has robust security measures in place to protect your Bitcoin.

- Fees: Compare the fees charged by different exchanges to find the most cost-effective option.

- Accessibility: Choose an exchange that is accessible in your country and supports your preferred payment methods.

3. Registering and Verifying Your Account

Once you have chosen a Bitcoin exchange, you will need to register and verify your account. This process typically involves providing personal information, such as your name, address, and phone number. You may also need to upload identification documents, such as a driver's license or passport, to comply with Know Your Customer (KYC) regulations.

Verifying your account is an essential step to ensure the security of your Bitcoin and comply with legal requirements. It may take a few days for your account to be verified, so plan accordingly.

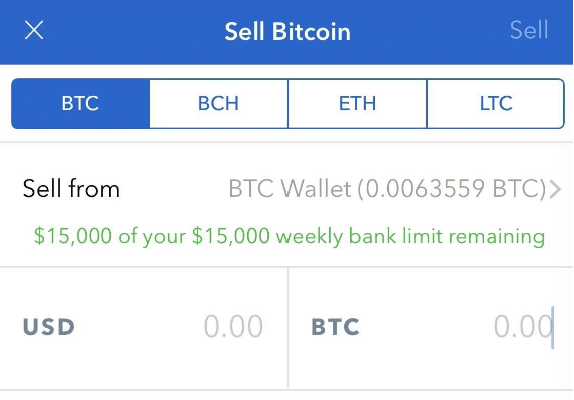

4. Selling Bitcoin for Cash

After your account is verified, you can proceed to sell your Bitcoin for cash. Most Bitcoin exchanges offer a simple interface that allows you to sell Bitcoin by entering the amount you wish to sell and selecting your preferred payment method.

When selling Bitcoin, consider the following:

- Payment Methods: Choose a payment method that is convenient and secure for you. Common options include bank transfers, credit/debit cards, and PayPal.

- Fees: Be aware of any fees associated with selling Bitcoin, as they can vary between exchanges and payment methods.

- Exchange Rates: Keep an eye on the exchange rates, as they can fluctuate while you are selling your Bitcoin.

5. Depositing Cash into a Bank Account

Once you have sold your Bitcoin for cash, the next step is to deposit the funds into a cash bank account. This process will depend on the payment method you chose during the sale.

If you used a bank transfer, the funds should be credited to your bank account within a few business days. If you used a credit/debit card or PayPal, the funds may be available immediately or within a few hours.

6. Managing Your Cash Bank Account

After successfully converting Bitcoin into a cash bank account, it is important to manage your funds responsibly. Keep track of your expenses and savings, and consider setting up automatic transfers to ensure you stay on top of your financial goals.

In conclusion, turning Bitcoin into a cash bank account is a straightforward process that involves understanding Bitcoin, choosing a reliable Bitcoin exchange, verifying your account, selling Bitcoin for cash, and depositing the funds into a bank account. By following this comprehensive guide, you can easily convert your Bitcoin into a cash bank account and manage your finances effectively.

This article address:https://www.iutback.com/crypto/84d26199654.html

Like!(5962)

Related Posts

- Bitcoin Price Summer 2020: A Volatile Journey

- Title: Optimizing Ubuntu Bitcoin Mining with GPU Power

- Title: Converter Satoshi to Bitcoin Cash: A Comprehensive Guide

- Bitcoin Cash Väärtus: The Future of Digital Currency

- Why Is Bitcoin Cash Up So Much?

- Visa to Bitcoin Wallet: A Seamless Transition for Modern Transactions

- Title: Converter Satoshi to Bitcoin Cash: A Comprehensive Guide

- **Electrum Bitcoin Wallet Tails: A Secure and Privacy-Focused Solution for Bitcoin Users

- Starting a Bitcoin Mining Operation: A Comprehensive Guide

- Where Can You Buy and Sell Bitcoins?

Popular

Recent

The Current Price of Bitcoin on Coingecko: A Comprehensive Analysis

Bitcoin Price and Volatility Over Time

Bitcoin Classic Mining: A Comprehensive Guide

Title: The Ultimate Guide to the Cheap Offline Bitcoin Wallet Computer

Bitcoin Mining with Tablet: A New Trend in Cryptocurrency

Bitcoin Trust Canada Stock: A Lucrative Investment Opportunity in the Cryptocurrency Market

Best Public Bitcoin Mining Companies: A Comprehensive Guide

Holo Crypto Binance: A Comprehensive Guide to the Future of Cryptocurrency Trading

links

- How to Send USDT from Binance to Trust Wallet: A Step-by-Step Guide

- How to Use LTC to Buy XRP on Binance: A Step-by-Step Guide

- Binance Chain in Metamask: A Comprehensive Guide to Integrating Binance Smart Chain with Ethereum's Popular Wallet

- Trezor Bitcoin Cash: The Ultimate Hardware Wallet for Secure Cryptocurrency Storage

- Why Does the Price of Bitcoin Go Up?

- How to Transfer Wrapped Bitcoin to a Bitcoin Wallet

- Which Bitcoin Mining App Gets Most Profitable: A Comprehensive Guide

- **NewsBTC Bitcoin Cash: A Deep Dive into the Cryptocurrency's Evolution and Future Prospects

- Binance Smart Chain Address for Metamask: A Comprehensive Guide to Interoperability

- Get Alerts for Bitcoin Price: Stay Updated and Make Informed Decisions