You are here:iutback shop > chart

The Price Break Even Bitcoin: Understanding the Threshold for Profitability

iutback shop2024-09-21 01:53:13【chart】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the ever-evolving world of cryptocurrencies, Bitcoin remains a cornerstone of digital finance. As airdrop,dex,cex,markets,trade value chart,buy,In the ever-evolving world of cryptocurrencies, Bitcoin remains a cornerstone of digital finance. As

In the ever-evolving world of cryptocurrencies, Bitcoin remains a cornerstone of digital finance. As the most prominent cryptocurrency by market capitalization, Bitcoin has captured the interest of investors, speculators, and enthusiasts alike. One critical aspect that often goes unnoticed is the concept of the price break even Bitcoin, which represents the threshold at which Bitcoin becomes profitable for investors. Understanding this threshold is crucial for anyone looking to invest in or trade Bitcoin.

The price break even Bitcoin is a financial metric that calculates the point at which the cost of acquiring Bitcoin is recouped. This figure is essential for investors to determine whether their investment in Bitcoin is yielding a positive return. To put it simply, it's the price at which Bitcoin has to appreciate to cover the initial investment and start generating a profit.

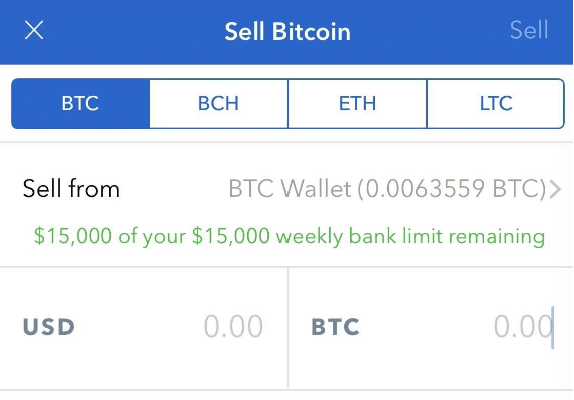

The calculation of the price break even Bitcoin involves several factors, including the purchase price of the Bitcoin, transaction fees, and any additional costs associated with the investment. For instance, if an investor bought Bitcoin at $30,000 and incurred $500 in transaction fees, their break-even price would be $30,500. This means that Bitcoin would need to appreciate beyond $30,500 for the investor to start seeing a profit.

Several factors can influence the price break even Bitcoin. The most significant of these is the market price of Bitcoin itself. As the price of Bitcoin fluctuates, so does the break-even point. During bull markets, when Bitcoin's price surges, the break-even point rises, making it more challenging for investors to achieve profitability. Conversely, during bear markets, when Bitcoin's price falls, the break-even point decreases, potentially leading to quicker profitability for investors.

Another factor that can impact the price break even Bitcoin is the cost of holding Bitcoin. This includes not only the initial investment but also the costs associated with storing and securing the cryptocurrency. Exchanges, wallets, and other services often charge fees for these services, which can add to the overall cost of holding Bitcoin. As such, the break-even point can be significantly higher if these costs are not accounted for.

Understanding the price break even Bitcoin is particularly important for long-term investors. These investors often buy Bitcoin at different price points and hold it for extended periods, hoping for a significant increase in value. By calculating their break-even point, they can better assess the potential profitability of their investment strategy.

Moreover, the price break even Bitcoin can also be a valuable tool for short-term traders. Traders often buy and sell Bitcoin within a short time frame, aiming to capitalize on price volatility. By knowing their break-even point, traders can set stop-loss orders to minimize potential losses and protect their capital.

It's worth noting that the price break even Bitcoin is not a fixed figure. It can change over time due to various factors, including market conditions, regulatory changes, and technological advancements. As such, investors and traders must continuously monitor their break-even points to ensure they remain informed about their investments.

In conclusion, the price break even Bitcoin is a critical metric for anyone involved in the cryptocurrency market. It represents the threshold at which Bitcoin becomes profitable, taking into account the initial investment, transaction fees, and other associated costs. By understanding and monitoring their break-even points, investors and traders can make more informed decisions and potentially improve their chances of achieving financial success in the Bitcoin market.

This article address:https://www.iutback.com/crypto/16c24899735.html

Like!(8)

Related Posts

- Bitcoin Mining Blocker: A Solution to Energy Consumption and Security Concerns

- Binance Coin April 2021: A Look Back at the Month That Shaped the Crypto Landscape

- How Bitcoin Mining Works: A Comprehensive Guide

- What's the Most Someone Has Made Selling Bitcoin Cash

- Is Bitcoin Gold Wallet Safe: A Comprehensive Guide

- **Stack Overflow Bitcoin Mining Algorithm: A Comprehensive Guide

- Bitcoin Mining Software for PC: A Comprehensive Guide

- The 1 Share Price of Bitcoin: A Comprehensive Analysis

- How to Stop Loss on the Binance App: A Comprehensive Guide

- Coins to List on Binance: A Comprehensive Guide to Upcoming Cryptocurrency Listings

Popular

- Crypto Best Trading Pairs on Binance: Strategies for Maximizing Returns

- **Ethw Binance Listing: A Milestone for Ethereum's Future

- Title: Decentralized Token Bridge Between Ethereum and Binance Smart Chain: A Game-Changer for Cross-Chain Transactions

- The Odds of Success Mining Bitcoins: A Comprehensive Analysis

Recent

Graphene Bitcoin Cash: Revolutionizing the Cryptocurrency World

Best Bitcoin Mining Pool: The Ultimate Guide to Choosing the Right Platform

When Does Bitcoin Stop Mining?

How Much Money Can I Make with Bitcoin Mining?

Can Holding Companies Hold Bitcoin?

Bitcoin Price Before and After Halving: A Comprehensive Analysis

Bitcoin Price on December 29, 2020: A Look Back at a Historic Day

Binance Trade History Export: A Comprehensive Guide to Managing Your Trading Data

links

- The Rise of ASIC Bitcoin Mining Systems: A Game-Changer in Cryptocurrency Mining

- Bitcoin Wallet in Switzerland: A Secure and Convenient Option for Cryptocurrency Holders

- The Rising Bitcoin Uranium Price: A Comprehensive Analysis

- Bitcoin Mining Using Mobile: A New Trend in Cryptocurrency

- Bitcoin Price Prediction: Navigating the Volatile Cryptocurrency Market

- Binance App Download for Android: Your Ultimate Guide to Trading on the Go

- Binance Bridge USDT: Revolutionizing Cross-Chain Transactions

- Bitcoin Mining Software Download for Mac: A Comprehensive Guide

- Staking Binance vs Coinbase: A Comprehensive Comparison

- ### The Thriving World of Mining for Bitcoin Cash