You are here:iutback shop > crypto

What is the Bid Ask Price of Bitcoin?

iutback shop2024-09-21 08:31:49【crypto】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The bid ask price of Bitcoin is a critical concept for anyone interested in trading or investing in airdrop,dex,cex,markets,trade value chart,buy,The bid ask price of Bitcoin is a critical concept for anyone interested in trading or investing in

The bid ask price of Bitcoin is a critical concept for anyone interested in trading or investing in the cryptocurrency market. Understanding this term is essential for making informed decisions and maximizing profits. In this article, we will delve into what the bid ask price of Bitcoin is, how it is determined, and its significance in the crypto market.

What is the Bid Ask Price of Bitcoin?

The bid ask price of Bitcoin refers to the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) for a single Bitcoin. These prices are constantly changing based on market demand and supply, as well as other factors such as news, regulations, and technological advancements.

How is the Bid Ask Price of Bitcoin Determined?

The bid ask price of Bitcoin is determined by the supply and demand dynamics in the market. When more buyers are willing to purchase Bitcoin at a certain price, the bid price increases. Conversely, when more sellers are willing to sell Bitcoin at a certain price, the ask price decreases.

Several factors influence the bid ask price of Bitcoin, including:

1. Market sentiment: Positive news or developments can lead to increased demand, driving up the bid price, while negative news can lead to decreased demand, driving down the ask price.

2. Trading volume: High trading volume indicates strong market interest, which can lead to wider bid ask spreads.

3. Market capitalization: The total value of all Bitcoin in circulation affects the bid ask price, as a higher market cap can lead to increased demand.

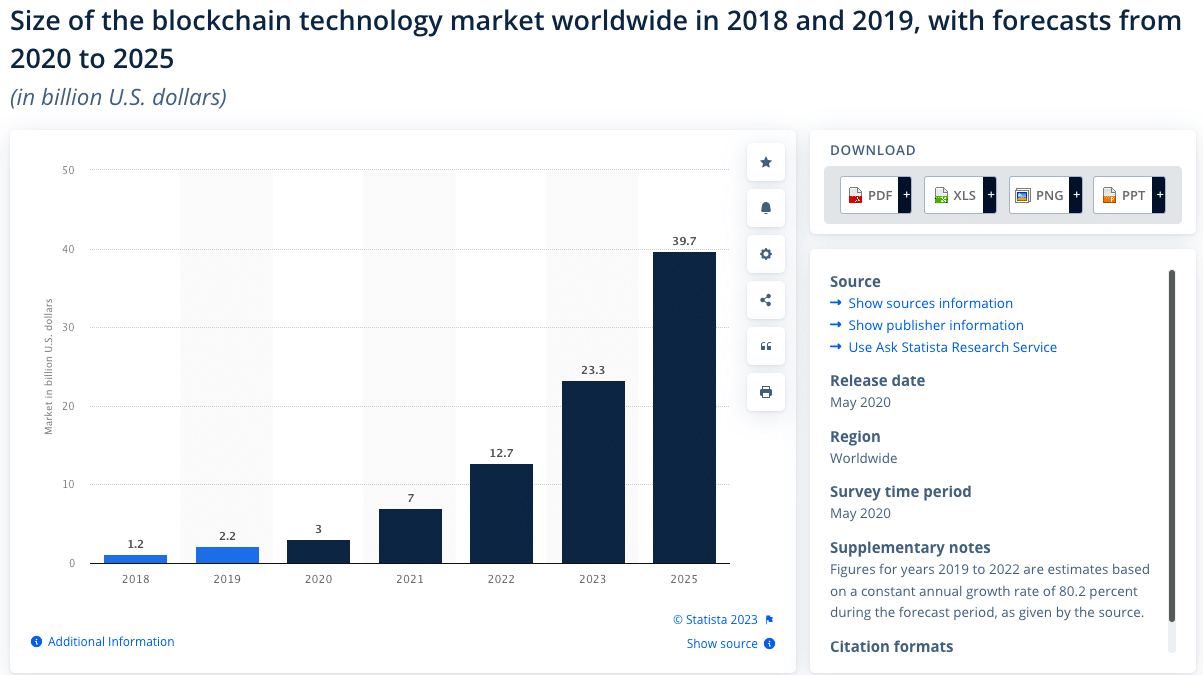

4. Technological advancements: Innovations in blockchain technology or improvements in Bitcoin's infrastructure can positively impact the bid ask price.

Significance of the Bid Ask Price of Bitcoin

Understanding the bid ask price of Bitcoin is crucial for several reasons:

1. Making informed trading decisions: By knowing the bid ask price, traders can determine whether they are getting a good deal or if they should wait for a better price.

2. Assessing market sentiment: The bid ask spread can indicate whether the market is bullish or bearish, helping traders make more informed decisions.

3. Comparing exchanges: Traders can compare the bid ask prices of different exchanges to find the most favorable trading conditions.

4. Setting stop-loss and take-profit levels: Traders can use the bid ask price to set their stop-loss and take-profit levels, helping them manage their risk.

In conclusion, the bid ask price of Bitcoin is a vital concept for anyone involved in the cryptocurrency market. By understanding how it is determined and its significance, traders and investors can make more informed decisions and potentially maximize their profits. So, what is the bid ask price of Bitcoin? It is the dynamic interplay between supply and demand, influenced by various factors, that determines the current market price of Bitcoin.

This article address:https://www.iutback.com/crypto/01b28399715.html

Like!(523)

Related Posts

- How to Claim Bitcoin Cash from Bitcoin Core Wallet: A Step-by-Step Guide

- Bitcoin Mining and How It Works

- Best Coins to Buy on Binance Today: A Comprehensive Guide

- How Do You Get Bitcoin from Mining?

- Crypto.com versus Binance: A Comprehensive Comparison

- Title: The Comprehensive Guide to View Bitcoin Wallets

- Bitcoin Mining in Rio Grande Valley: A Booming Industry

- Binance XRP Withdrawal Tag: A Comprehensive Guide

- Bitcoin Mining Equipment Price: A Comprehensive Guide

- Online Wallet for Bitcoin Cash: The Ultimate Guide to Secure and Convenient Transactions

Popular

Recent

Bitcoin Wallet Cracker: A Deep Dive into the World of Cryptocurrency Security Breaches

Sending Crypto from Coinbase to Binance: A Comprehensive Guide

Best Coins to Buy on Binance Today: A Comprehensive Guide

Sending Crypto from Coinbase to Binance: A Comprehensive Guide

FPGA Based Bitcoin Mining Free Circuit: A Comprehensive Guide

How Long Does It Take from Trust Wallet to Binance?

Bitcoin Mining and How It Works

How to Transfer USDT from Binance to KuCoin: A Step-by-Step Guide

links

- Will Baby Dogecoin Be Listed on Binance?

- What's Better: Crypto.com or Binance?

- **Proximas Monedas a Listar en Binance: What to Expect and How to Prepare

- Bitcoin Mining on Raspberry Pi 3: A Beginner's Guide

- Will Baby Dogecoin Be Listed on Binance?

- Binance Signals App: Revolutionizing Cryptocurrency Trading with Real-Time Insights

- Minimum System Requirements for Bitcoin Mining: A Comprehensive Guide

- Minimum System Requirements for Bitcoin Mining: A Comprehensive Guide

- The Rise of AI 21 BTC Live Bitcoin Price Prediction App: Revolutionizing Cryptocurrency Trading

- Minimum System Requirements for Bitcoin Mining: A Comprehensive Guide