You are here:iutback shop > markets

Who is Manipulating Bitcoin Price?

iutback shop2024-09-20 22:38:29【markets】8people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's most popular cryptocurrency, has been a subject of intense debate and speculati airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's most popular cryptocurrency, has been a subject of intense debate and speculati

Bitcoin, the world's most popular cryptocurrency, has been a subject of intense debate and speculation. One of the most frequently asked questions is: who is manipulating Bitcoin price? The answer to this question is not straightforward, as there are several factors at play. In this article, we will explore the potential culprits behind the manipulation of Bitcoin price.

First and foremost, it is essential to understand that Bitcoin's price is influenced by a variety of factors, including supply and demand, market sentiment, regulatory news, and technological advancements. However, some individuals and entities may be more influential in manipulating the price than others.

One potential culprit is large institutional investors. These investors have the financial power to move the market significantly. For instance, when a major institutional investor decides to buy or sell a large amount of Bitcoin, it can cause a significant price movement. Similarly, when a well-known investor expresses their opinion on Bitcoin, it can sway the market sentiment and influence the price.

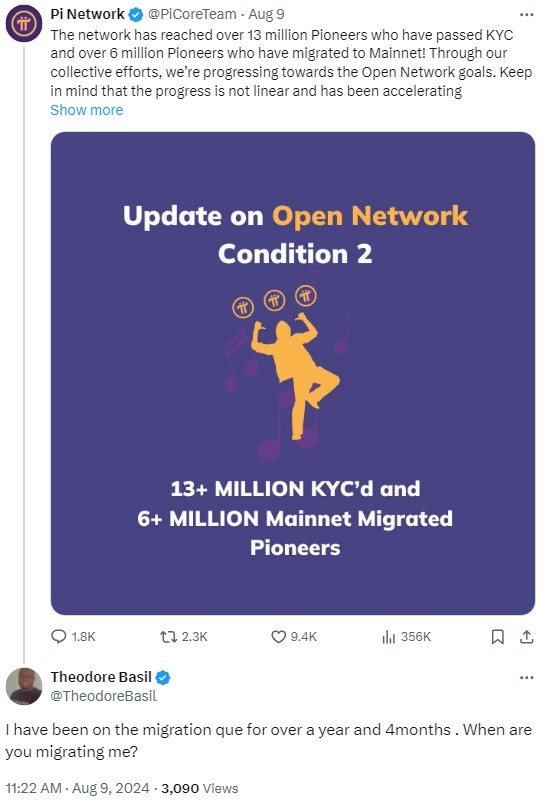

Another potential manipulator is cryptocurrency exchanges. Exchanges play a crucial role in the Bitcoin market, as they are the platforms where traders buy and sell Bitcoin. Some exchanges have been accused of wash trading, where they create artificial demand or supply to manipulate the price. Additionally, exchanges may also be subject to regulatory scrutiny, which can impact their operations and, in turn, the price of Bitcoin.

Furthermore, whales, or individuals who own a significant amount of Bitcoin, may also manipulate the price. Whales can move the market by selling a large portion of their holdings, causing the price to plummet. Conversely, they can also drive the price up by buying a substantial amount of Bitcoin. This behavior is known as "whale trading," and it can have a significant impact on the market.

Moreover, regulatory bodies and governments may also play a role in manipulating Bitcoin price. For instance, when a government announces strict regulations on cryptocurrencies, it can cause a sell-off and drive the price down. Conversely, when a government supports the use of cryptocurrencies, it can boost investor confidence and drive the price up.

Lastly, media reports and social media can also influence Bitcoin price. When a news outlet publishes a story about Bitcoin, it can cause a surge in demand or sell-off, depending on the content of the article. Similarly, social media influencers can also sway the market by expressing their opinions on Bitcoin.

In conclusion, several factors and entities can manipulate Bitcoin price. While it is challenging to pinpoint the exact culprits, it is essential to be aware of the potential manipulators and their influence on the market. As Bitcoin continues to grow in popularity, it is crucial for investors to stay informed and make informed decisions based on thorough research and analysis.

Remember, who is manipulating Bitcoin price is a complex question with no definitive answer. However, by understanding the potential culprits and their influence, investors can better navigate the volatile cryptocurrency market and make more informed decisions. So, who is manipulating Bitcoin price? The answer may lie in a combination of these factors, and only time will tell.

This article address:https://www.iutback.com/blog/98d26099641.html

Like!(3572)

Related Posts

- Claim Bitcoin Wallet: A Comprehensive Guide to Securely Managing Your Cryptocurrency

- What Countries Can Trade on Binance: A Comprehensive Guide

- Title: How to Transfer Bitcoin to a Paper Wallet: A Secure and Private Solution

- Ledger Nano Split Bitcoin Cash: A Comprehensive Guide to Securely Managing Your Bitcoin Cash Holdings

- Bitclub Bitcoin Cloud Mining: A Comprehensive Guide to the World of Cryptocurrency Investment

- How to Make Money Off Bitcoin on Cash App: A Comprehensive Guide

- Binance Coin to USDT: A Comprehensive Guide to Trading and Investment

- Where Do I Find My Bitcoin Wallet Address on Coinbase?

- Bitcoin Price from 2015 to 2020: A Comprehensive Analysis

- Binance US App Safe: Ensuring Secure Trading on the Go

Popular

Recent

Bitcoin Worth 365 Moved to Two Wallets: A Closer Look at the Transaction

Cashing in Large Amount of Bitcoins: A Comprehensive Guide

Bitcoin Mining Why: The Economic and Technological Underpinnings

What is Binance Chain Network?

How Do I Do Bitcoin on Cash App?

**Litecoin or Binance Coin: A Comparative Analysis of Two Cryptocurrencies

Bitcoin GPU Mining Software Windows: A Comprehensive Guide

How to Convert Cash App to Bitcoin: A Comprehensive Guide

links

- How to Transfer Bitcoin from Coinbase to Binance: A Step-by-Step Guide

- Where Can U Buy Bitcoins: A Comprehensive Guide

- Mega Mining Cloud Bitcoin Mining: A Game-Changing Solution for Cryptocurrency Enthusiasts

- Title: Troubleshooting: Can't Find Bitcoin Address on Cash App

- The Current State of MBTC Bitcoin Price: A Comprehensive Analysis

- The Bitcoin Launch Price in 2009: A Journey Through Time

- The Rise of Bitcoin Mining: A Game-Changing Technology

- Binance BNB Hack: The Aftermath and Lessons Learned

- Trade Cash for Bitcoin: The Future of Digital Currency

- Binance US: Your Gateway to Easy Crypto Purchases