You are here:iutback shop > trade

Gold Price vs Bitcoin: A Comprehensive Analysis

iutback shop2024-09-20 23:24:12【trade】7people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the debate between gold and Bitcoin has been a hot topic among investors and econom airdrop,dex,cex,markets,trade value chart,buy,In recent years, the debate between gold and Bitcoin has been a hot topic among investors and econom

In recent years, the debate between gold and Bitcoin has been a hot topic among investors and economists. Both are considered safe-haven assets, but they differ in many aspects. This article aims to provide a comprehensive analysis of the gold price vs Bitcoin, highlighting their similarities, differences, and future prospects.

Firstly, let's discuss the similarities between gold and Bitcoin. Both are considered safe-haven assets, meaning they tend to hold their value or even increase in value during times of economic uncertainty or market turmoil. This is because both gold and Bitcoin are scarce and have limited supply. Gold has been used as a store of value for centuries, while Bitcoin was created as a decentralized digital currency.

One of the main differences between gold and Bitcoin is their nature. Gold is a physical asset, while Bitcoin is a digital asset. This means that gold can be physically held and stored, whereas Bitcoin exists only on a network of computers. This difference has implications for their storage, transportation, and insurance costs.

Another significant difference is the supply and demand dynamics. Gold has a finite supply, as it is mined from the earth. On the other hand, Bitcoin has a predetermined supply limit of 21 million coins, which is expected to be reached by 2140. This scarcity in Bitcoin's supply has led to its price increasing significantly over the years.

When comparing the gold price vs Bitcoin, it's essential to consider their historical performance. Gold has been a stable investment for centuries, with its price often rising during economic downturns. Bitcoin, on the other hand, has experienced extreme volatility, with its price skyrocketing and crashing multiple times. This volatility has made Bitcoin a risky investment for some, while others view it as a high-potential asset.

One of the main arguments in favor of Bitcoin is its potential to disrupt traditional financial systems. Bitcoin's decentralized nature means that it is not controlled by any government or central authority, making it immune to inflation and currency manipulation. This has led many to believe that Bitcoin could become the future of money.

However, gold has a long history of being a reliable store of value and a hedge against inflation. Its physical nature also makes it a tangible asset that can be easily transferred and stored. Moreover, gold is widely recognized and accepted globally, while Bitcoin's adoption is still relatively low compared to gold.

In terms of future prospects, the gold price vs Bitcoin debate will likely continue. Some experts believe that Bitcoin will eventually surpass gold in terms of value and adoption, while others argue that gold's historical track record and physical nature will ensure its dominance as a safe-haven asset.

In conclusion, the gold price vs Bitcoin debate is a complex one, with both assets having their strengths and weaknesses. While gold has been a reliable store of value for centuries, Bitcoin offers the potential to disrupt traditional financial systems. Investors must weigh these factors and consider their risk tolerance before deciding which asset to invest in. As the world continues to evolve, it remains to be seen which asset will ultimately emerge as the winner in the gold price vs Bitcoin battle.

This article address:https://www.iutback.com/blog/86b33899575.html

Like!(1694)

Related Posts

- Binance BTC LTC: A Comprehensive Guide to Trading on Binance

- What's the Highest Bitcoin Price?

- Can I Receive a Bitcoin Without a Vault Key?

- Cash Out Bitcoin Without Bank Account: Exploring Alternatives for Digital Currency Holders

- Bitcoin Mining Taxes in the United States: Understanding the Implications

- Buy Bitcoin Futures Price: A Comprehensive Guide to Understanding and Investing in Bitcoin Futures

- Bitcoin Cash EUR Coingecko: A Comprehensive Look at the Cryptocurrency's Market Performance

- How to Get Bitcoin Cash Fork Coin: A Comprehensive Guide

- The Current Price of Bitcoin AUD: A Comprehensive Analysis

- Can U Buy Bitcoin on Fidelity?

Popular

- The recent surge in the cryptocurrency market has captured the attention of investors and enthusiasts alike. One particular figure that has been making waves is the 2.511 bitcoin price. This article delves into the factors contributing to this significant figure and explores its implications for the future of digital currencies.

- Binance USDT Transfer: A Comprehensive Guide to Secure and Efficient Transactions

- Can I Get My Bitcoins If I Have the Receipt?

- Bitcoin Cash EUR Coingecko: A Comprehensive Look at the Cryptocurrency's Market Performance

Recent

Bitcoin.com Wallet App Download: A Comprehensive Guide to Secure Cryptocurrency Management

How to Get a Bitcoin Wallet: A Comprehensive Guide

Title: Enhancing Your Cryptocurrency Experience with Bitcoin Wallet Ubuntu

How to Get a Bitcoin Wallet: A Comprehensive Guide

Bitcoin Mystery Wallet: Unraveling the Enigma of Digital Currency

Bitcoin Cash USD Price Chart: A Comprehensive Analysis

Is Doge Coin on Binance: A Comprehensive Guide

Does Binance Have a Wallet? A Comprehensive Guide

links

- Buy Limit on Binance: A Comprehensive Guide to Understanding and Utilizing This Trading Tool

- How to Get My Bitcoin Cash from XYZ Points

- Import Bitcoin Wallet to Blockchain: A Comprehensive Guide

- How to Turn Bitcoin into USD on Binance: A Step-by-Step Guide

- Can You Create a Bitcoin Wallet Offline?

- **Bitcoin Mining Profitability 2024: A Comprehensive Analysis

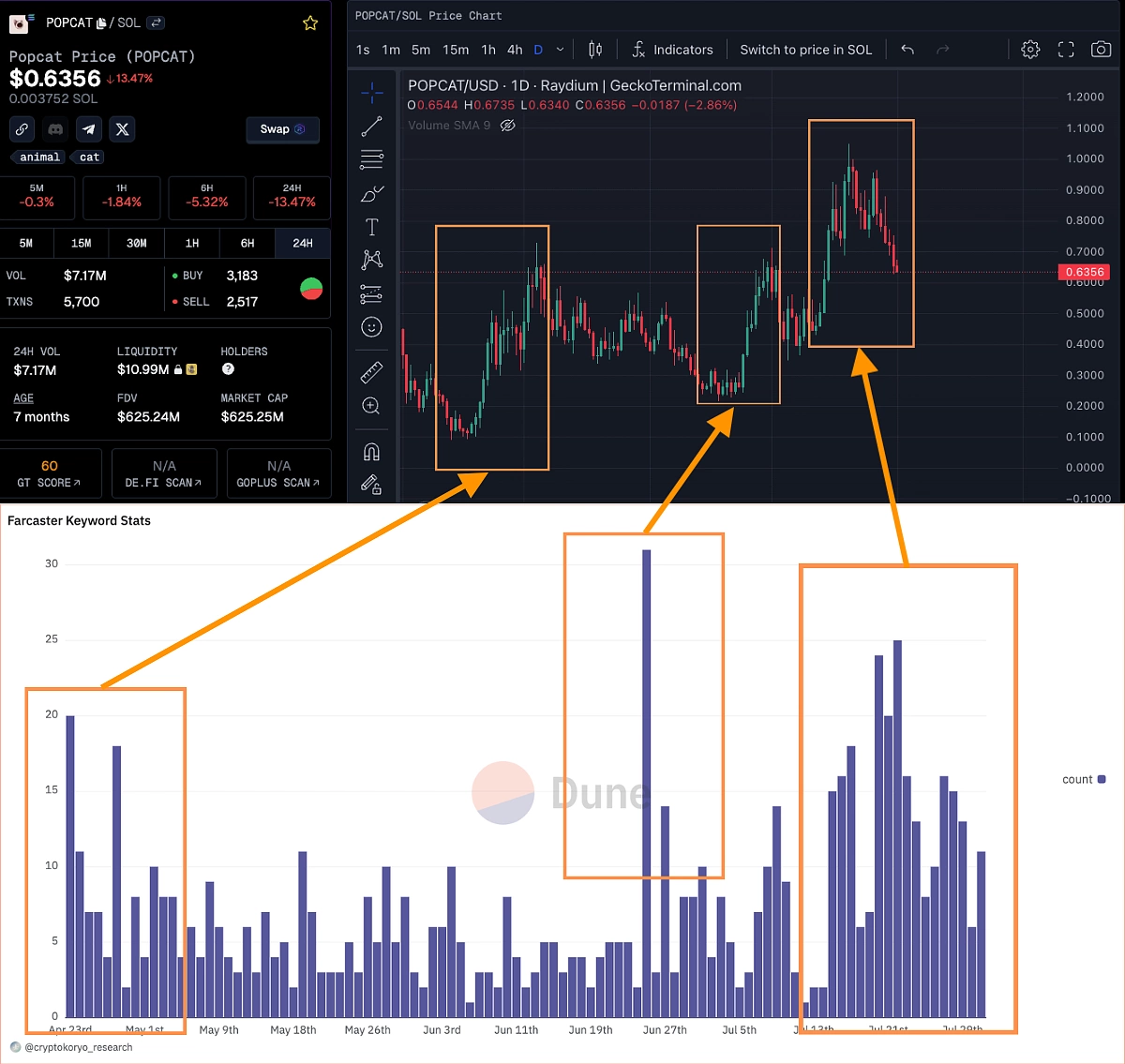

- Etoro Bitcoin Price Chart: A Comprehensive Analysis

- Bitcoin Cash to Perfect Money: A Seamless Financial Gateway

- Bitcoin Prices in 2020: A Year of Volatility and Hope

- Import Bitcoin Wallet to Blockchain: A Comprehensive Guide