You are here:iutback shop > crypto

Bitcoin Price High Low: Understanding the Volatility and Its Implications

iutback shop2024-09-20 23:39:24【crypto】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized cryptocurrency, has been a topic of intense interest and de airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized cryptocurrency, has been a topic of intense interest and de

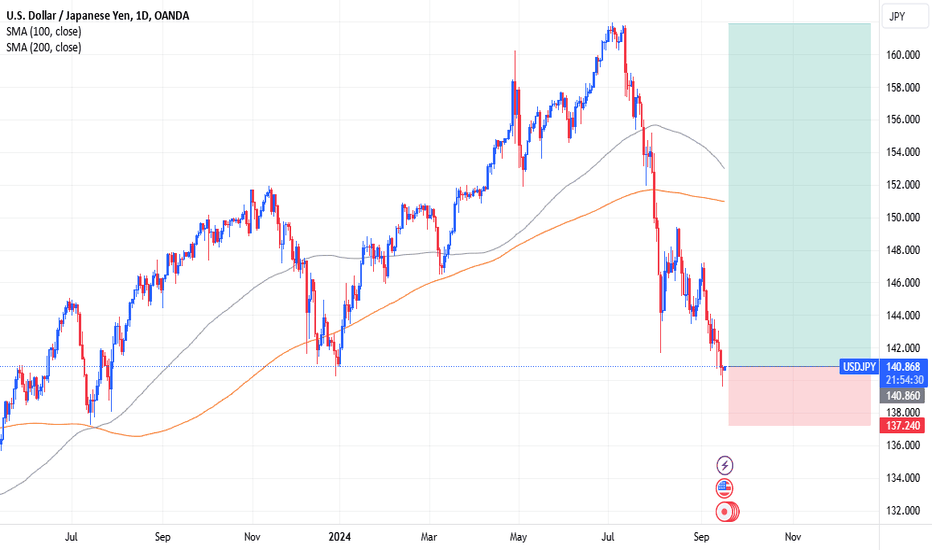

Bitcoin, the world's first decentralized cryptocurrency, has been a topic of intense interest and debate since its inception in 2009. One of the most discussed aspects of Bitcoin is its price, which has experienced extreme volatility over the years. This article aims to delve into the factors contributing to Bitcoin's price fluctuations, specifically focusing on its high and low points.

Bitcoin's price has seen numerous highs and lows, making it a highly speculative asset. The first significant high point for Bitcoin was in 2011, when its price surged from $0.30 to $31.90 in just a few months. This surge was attributed to a growing interest in digital currencies and the increasing number of Bitcoin exchanges. However, this high was short-lived, and the price quickly plummeted to $2.00 by the end of the year.

The next major high for Bitcoin came in 2013, when the price skyrocketed from $13.50 to an all-time high of $1,100. This surge was driven by a combination of factors, including regulatory news, media coverage, and institutional interest. However, the price bubble burst in 2014, and Bitcoin's value plummeted to around $200.

Bitcoin's price has continued to experience significant volatility, with numerous highs and lows since then. In 2017, Bitcoin reached another all-time high of nearly $20,000, driven by a frenzy of retail and institutional investors. However, the price crashed to around $3,200 by the end of the year, marking a 84% decline.

The factors contributing to Bitcoin's price volatility can be attributed to several key factors:

1. Supply and demand: Like any other asset, Bitcoin's price is influenced by the basic economic principle of supply and demand. When demand for Bitcoin increases, its price tends to rise, and vice versa. This is particularly true in the cryptocurrency market, where speculative trading and FOMO (fear of missing out) can drive prices to extreme levels.

2. Regulatory news: The regulatory landscape surrounding cryptocurrencies is still evolving, and any news related to regulations can have a significant impact on Bitcoin's price. For instance, when China announced its ban on cryptocurrency mining in 2021, Bitcoin's price dropped by over 10%.

3. Media coverage: The media plays a crucial role in shaping public perception of Bitcoin. Positive news, such as mainstream adoption or partnerships with established companies, can drive prices higher, while negative news, such as hacks or security breaches, can lead to a price decline.

4. Market sentiment: Investor sentiment can be highly influential in the cryptocurrency market. When investors are optimistic about Bitcoin's future, they are more likely to buy, driving prices up. Conversely, when sentiment turns negative, investors may sell off their holdings, leading to a price drop.

Understanding Bitcoin's price high and low points is essential for investors and enthusiasts alike. While the cryptocurrency market is known for its volatility, it is crucial to conduct thorough research and consider the risks before investing. As Bitcoin continues to evolve, its price will likely continue to experience highs and lows, making it a fascinating asset to watch in the years to come.

This article address:https://www.iutback.com/blog/76c36099563.html

Like!(86871)

Related Posts

- Can I Buy Bitcoin on Scottrade?

- Bitcoin Power Coin Price: A Comprehensive Analysis

- Can Federal Employees Own Bitcoin?

- The Rise of Bitcoin: Discovering the Cheapest Price for Cryptocurrency

- How Much is a Bitcoin Mining Machine: A Comprehensive Guide

- How to Build a Bitcoin Mining Computer 2017: A Comprehensive Guide

- Why Did People Stop Mining Bitcoins?

- Unlocking the Potential of Bitcoin Diamond Wallet Binance: A Comprehensive Guide

- Bitcoin Price in India Right Now: A Comprehensive Analysis

- Is It Better to Mine Bitcoin When Its Low Price?

Popular

Recent

Binance Withdrawal Reddit: A Comprehensive Guide to Binance Withdrawal Process

The Rise of RTX Bitcoin Mining: A Game Changer in Cryptocurrency Mining

Bitcoin Forks Price: The Impact on the Cryptocurrency Market

Who Are the Binance Chain Validators?

Binance Community Coin Round 5: A New Era of Blockchain Innovation

Trade Bitcoin Cash to Bitcoin: A Comprehensive Guide

Why Can't I Find Shib on Binance?

Student Coin Binance Listing: A Game-Changer for the Crypto Community

links

- How to Buy Token on Binance Smart Chain: A Step-by-Step Guide

- How to Buy Token on Binance Smart Chain: A Step-by-Step Guide

- Can You Guess Someone's Bitcoin Wallet?

- Alternative Methods to Brute Force Bitcoin Wallets

- Can I Transfer Bitcoin from Etoro Trade to Balance?

- How to Buy Bitcoin Cash App: A Comprehensive Guide

- Binance Suspends Withdrawals Amidst Security Concerns

- How to Get a Binance Smart Chain Wallet: A Comprehensive Guide

- ### Exploring the Potential of ADA Binance Chain: A New Era in Blockchain Technology

- The 22 Bitcoin Price: A Comprehensive Analysis