You are here:iutback shop > block

The Tether Price on Binance: A Comprehensive Analysis

iutback shop2024-09-20 23:21:30【block】1people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the ever-evolving world of cryptocurrency, Tether (USDT) has emerged as one of the most stable an airdrop,dex,cex,markets,trade value chart,buy,In the ever-evolving world of cryptocurrency, Tether (USDT) has emerged as one of the most stable an

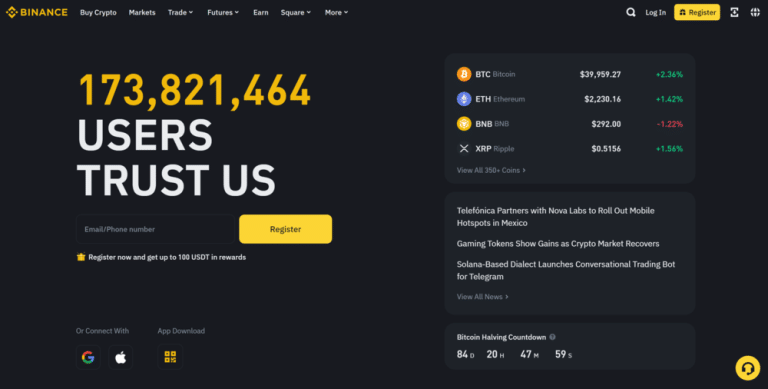

In the ever-evolving world of cryptocurrency, Tether (USDT) has emerged as one of the most stable and widely used digital currencies. Its price on Binance, the world's leading cryptocurrency exchange, has been a topic of interest for many investors and traders. This article aims to provide a comprehensive analysis of the Tether price on Binance, exploring its factors, trends, and implications.

Firstly, let's understand what Tether is. Tether is a cryptocurrency that aims to bridge the gap between traditional fiat currencies and digital currencies. It is backed by a reserve of fiat currencies, primarily the US dollar, and is designed to maintain a 1:1 ratio with the dollar. This stability makes Tether an attractive option for investors looking for a safe haven in the volatile cryptocurrency market.

Binance, as the largest cryptocurrency exchange by trading volume, plays a crucial role in determining the Tether price. The Tether price on Binance is influenced by various factors, including market demand, trading volume, and liquidity. Here's a closer look at these factors:

1. Market Demand: The demand for Tether on Binance is driven by several factors. Firstly, Tether is often used as a medium of exchange to facilitate transactions between different cryptocurrencies. Secondly, it serves as a stable store of value, allowing investors to park their assets during market downturns. Lastly, Tether is widely used for margin trading and leveraged positions on Binance, making it a popular choice for traders.

2. Trading Volume: The trading volume of Tether on Binance is a key indicator of its popularity and liquidity. A higher trading volume suggests that more investors are actively participating in the market, which can lead to price stability. Conversely, a lower trading volume may indicate a lack of interest or uncertainty, potentially affecting the Tether price.

3. Liquidity: Liquidity refers to the ease with which an asset can be bought or sold without causing a significant impact on its price. High liquidity in Tether on Binance ensures that investors can enter and exit positions without facing significant slippage. This liquidity is crucial for maintaining the stability of the Tether price.

Now, let's analyze the Tether price on Binance over the past few months. In recent times, the Tether price on Binance has exhibited a relatively stable trend, hovering around the $1 mark. This stability can be attributed to the increasing adoption of Tether as a medium of exchange and a stable store of value.

However, it is important to note that the Tether price on Binance can still be influenced by external factors, such as regulatory news, market sentiment, and global economic conditions. For instance, in response to regulatory concerns, Tether has faced scrutiny from regulators around the world, which can impact its price on Binance.

In conclusion, the Tether price on Binance is a crucial indicator of its stability and popularity in the cryptocurrency market. Factors such as market demand, trading volume, and liquidity play a significant role in determining its price. While Tether has proven to be a reliable digital currency, investors should remain vigilant about external factors that can impact its price on Binance. By understanding these factors, investors can make informed decisions and capitalize on the opportunities presented by the Tether price on Binance.

This article address:https://www.iutback.com/blog/65e45499480.html

Like!(3)

Related Posts

- Why Is Bitcoin Mining Noisy?

- How to Buy CHZ on Binance: A Step-by-Step Guide

- How to Add Binance Chain to Metamask: A Step-by-Step Guide

- Bitcoin Mining on Server: A Comprehensive Guide

- How Much is 1 Bitcoin Cash in Naira?

- When Shiba Inu Listed on Binance: A Game-Changing Move for the Cryptocurrency World

- ### The Evolution of Slush Bitcoin Mining: A Journey into Cryptocurrency Mining

- Binance Freeze Withdrawals: What You Need to Know

- The Price of Bitcoin at the End of 2021: A Look Back and Forward

- Bitcoin Price Bankomat: Revolutionizing the Way We Access Cryptocurrency

Popular

Recent

Bitcoin Price 2014 to 2019: A Journey Through the Volatile Cryptocurrency Landscape

Binance Coin App Download: A Comprehensive Guide to the Ultimate Cryptocurrency Trading Experience

The Price of Bitcoin on Luno: A Comprehensive Analysis

Binance Trade Gold: A Comprehensive Guide to Investing in Gold on Binance

How to Buy Bitcoin Cash with Credit Card: A Step-by-Step Guide

Bitcoin Wallet Pen Drive: A Secure and Convenient Solution for Cryptocurrency Storage

Can I Send Unconfirmed Bitcoin?

When Shiba Inu Listed on Binance: A Game-Changing Move for the Cryptocurrency World

links

- Cash Out Bitcoin Singapore: A Guide to Converting Cryptocurrency to Cash

- Bitcoin Mining ID Card: A New Era in Cryptocurrency Verification

- 3x Long Bitcoin Token Price Prediction: Navigating the Volatile Cryptocurrency Landscape

- Bitcoin Price in India: A Comprehensive Analysis

- Title: Implementing a C# Application to Get Bitcoin Price

- Greenidge Generation's Bitcoin Mining Facility: A Game-Changer in the Crypto World

- Bitcoin Cash (BCH), also known as Bitcoin Cash ABC (BCC), has been a topic of great interest in the cryptocurrency community since its inception in 2017. This article aims to provide an overview of Bitcoin Cash, its history, and its significance in the world of digital currencies.

- **The Future Value Price of Bitcoin: A Glimpse into the Cryptocurrency's Potential

- How to Send USDT from Metamask to Binance: A Step-by-Step Guide

- Bitcoin Wallet Brute Force GitHub: A Deep Dive into Security and Vulnerabilities