You are here:iutback shop > markets

Can I Use IRA to Buy Bitcoin?

iutback shop2024-09-20 23:34:47【markets】3people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the rise of cryptocurrencies has sparked a lot of interest among investors. Bitcoin airdrop,dex,cex,markets,trade value chart,buy,In recent years, the rise of cryptocurrencies has sparked a lot of interest among investors. Bitcoin

In recent years, the rise of cryptocurrencies has sparked a lot of interest among investors. Bitcoin, as the most popular cryptocurrency, has gained significant attention. Many people are wondering if they can use their Individual Retirement Accounts (IRAs) to invest in Bitcoin. In this article, we will explore the possibility of using an IRA to buy Bitcoin and the potential benefits and risks involved.

Can I Use IRA to Buy Bitcoin?

Yes, you can use your IRA to buy Bitcoin. However, it is important to note that not all IRAs are designed for cryptocurrency investments. Traditional IRAs and Roth IRAs are the most common types of IRAs, and they have different rules and regulations.

Traditional IRA vs. Bitcoin

A traditional IRA is a tax-deferred retirement account, meaning that you won't pay taxes on the contributions or earnings until you withdraw the money in retirement. However, you may be subject to a 10% penalty if you withdraw funds before the age of 59½.

Bitcoin, on the other hand, is a digital asset that operates independently of any government or financial institution. Its value can be highly volatile, and it is considered a high-risk investment.

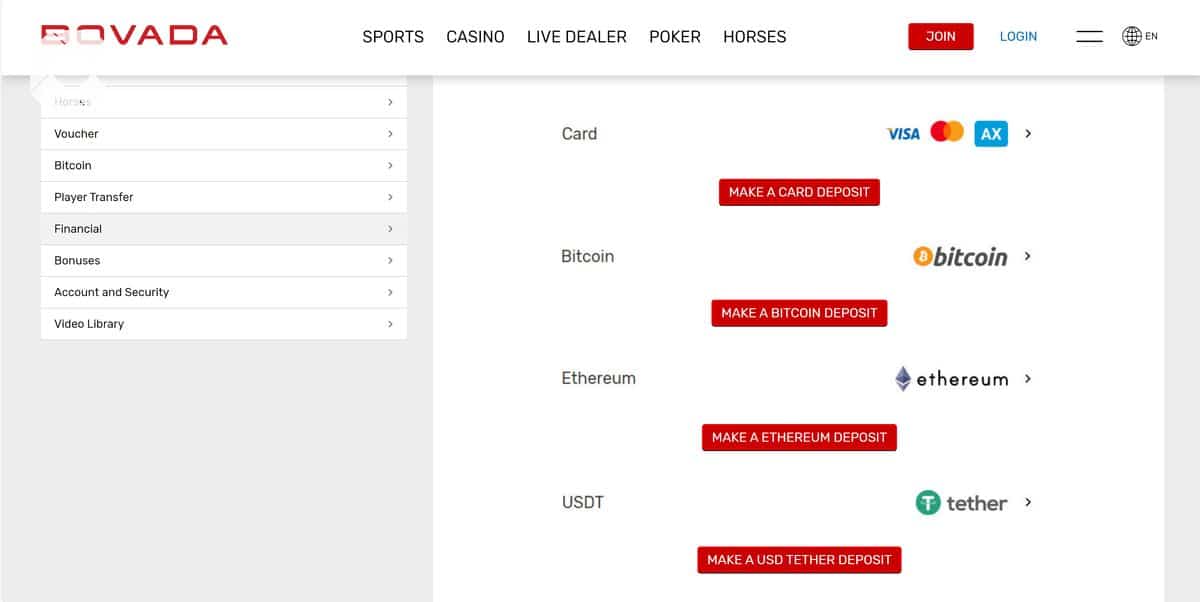

To use your traditional IRA to buy Bitcoin, you will need to set up a self-directed IRA. This type of IRA allows you to invest in a wider range of assets, including cryptocurrencies. However, you should be aware that self-directed IRAs come with higher fees and more stringent rules.

Roth IRA vs. Bitcoin

A Roth IRA is a retirement account that allows you to contribute after-tax dollars, and all earnings and withdrawals are tax-free in retirement. This makes it an attractive option for long-term investments.

Similar to a traditional IRA, you can set up a self-directed Roth IRA to invest in Bitcoin. However, it is important to note that Roth IRAs have income limits, and not everyone may be eligible to contribute.

Benefits of Using IRA to Buy Bitcoin

1. Tax-deferred growth: By investing in Bitcoin through a traditional IRA, you can benefit from tax-deferred growth, allowing your investments to grow without being taxed until you withdraw them in retirement.

2. Tax-free growth: If you invest in Bitcoin through a Roth IRA, you can enjoy tax-free growth and withdrawals in retirement.

3. Diversification: Adding Bitcoin to your IRA can help diversify your investment portfolio, reducing your exposure to traditional stocks and bonds.

Risks of Using IRA to Buy Bitcoin

1. Volatility: Bitcoin is known for its high volatility, which means its value can fluctuate significantly in a short period of time. This can pose a risk to your retirement savings.

2. Regulatory uncertainty: Cryptocurrencies are still relatively new, and regulations surrounding them are still evolving. This can create uncertainty and potential legal issues for investors.

3. Security concerns: While Bitcoin is generally considered secure, there are still risks associated with storing and transferring cryptocurrencies. This can pose a risk to your IRA funds.

In conclusion, you can use your IRA to buy Bitcoin, but it is important to consider the potential benefits and risks involved. Before making any investment decisions, consult with a financial advisor to ensure that investing in Bitcoin aligns with your retirement goals and risk tolerance. Remember, the decision to use your IRA to buy Bitcoin should be well-informed and based on a thorough understanding of the associated risks.

This article address:https://www.iutback.com/blog/49f51399437.html

Like!(5779)

Related Posts

- What is Bitcoin Cash App?

- What is Bitcoin Mining?

- The Blockchain on the High Seas: Bitcoin Price and Its Impact

- Bitcoin Price Elon: The Impact of Elon Musk on Cryptocurrency's Value

- How to Buy Other Currencies on Binance: A Step-by-Step Guide

- The cheapest graphics card for bitcoin mining: How to choose the right one

- **The Advantages of Using a Self Hosted Bitcoin Wallet

- How to Recover My Bitcoin Wallet Password: A Step-by-Step Guide

- Bitcoin ABC Wallet Safe: Ensuring Secure and Reliable Cryptocurrency Storage

- How to Cancel Withdraw on Binance: A Step-by-Step Guide

Popular

Recent

Bitcoin Price Prediction Using Python Code: A Comprehensive Guide

Dogecoin Binance Withdrawal: A Comprehensive Guide

Binance Spot Wallet vs P2P Wallet: A Comprehensive Comparison

What is Bitcoin Mining?

Bitcoin Price Weekly Trend: Analysis and Predictions

Bitcoin Mining Machine in Pakistan: A Booming Industry

Best Bitcoin Wallet: A Comprehensive Guide to Secure and Efficient Cryptocurrency Management

Bitcoin Price on December 11, 2017: A Milestone in Cryptocurrency History

links

- Bitcoin Cloud Mining Login: A Comprehensive Guide to Secure and Efficient Access

- What Sets the Price of Bitcoin?

- Can I Trade Bitcoin on Coinbase?

- The Raven Bitcoin 2014 Price: A Look Back at the Cryptocurrency's Evolution

- Bitcoin Cloud Mining Login: A Comprehensive Guide to Secure and Efficient Access

- What App Do You Use to Buy Bitcoin Cash?

- How to Send Crypto from Binance to Wallet: A Step-by-Step Guide

- When Bitcoin Mining Will End: A Comprehensive Analysis

- The Rise of Wallet Bitcoin USB: A Secure and Convenient Solution for Cryptocurrency Storage

- Kaspa Wallet Binance: The Ultimate Guide to Managing Your Kaspa Cryptocurrency