You are here:iutback shop > markets

Bitcoin Price May Dip Below $30,000: What You Need to Know

iutback shop2024-09-20 23:27:36【markets】4people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The cryptocurrency market has been experiencing a rollercoaster ride in recent months, with Bitcoin airdrop,dex,cex,markets,trade value chart,buy,The cryptocurrency market has been experiencing a rollercoaster ride in recent months, with Bitcoin

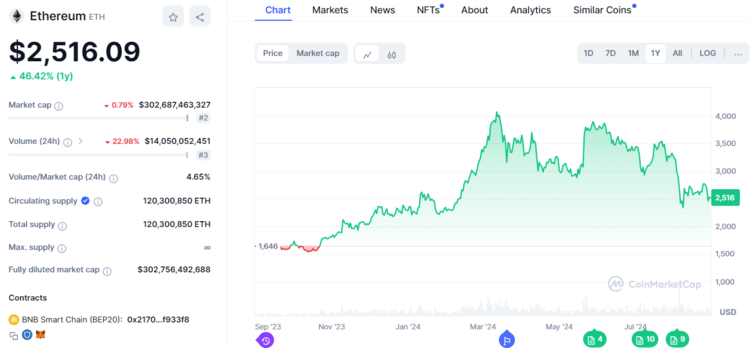

The cryptocurrency market has been experiencing a rollercoaster ride in recent months, with Bitcoin leading the pack. However, experts are now predicting that the Bitcoin price may dip below $30,000. In this article, we will explore the reasons behind this prediction and what it means for investors.

Firstly, it's important to understand that the cryptocurrency market is highly volatile. Unlike traditional financial markets, the crypto market is driven by a variety of factors, including technological advancements, regulatory changes, and market sentiment. As a result, the Bitcoin price can fluctuate rapidly, making it challenging for investors to predict future trends.

One of the primary reasons why the Bitcoin price may dip below $30,000 is the increasing regulatory scrutiny. Governments around the world are taking a closer look at cryptocurrencies, with some countries considering outright bans or strict regulations. This uncertainty has led to a loss of confidence among investors, causing the Bitcoin price to drop.

Another factor contributing to the potential dip in the Bitcoin price is the growing supply of Bitcoin. According to the Bitcoin halving schedule, the reward for mining Bitcoin is halved every four years. The next halving is expected to occur in 2024, which could lead to a decrease in the supply of new Bitcoin. However, some experts believe that the current supply of Bitcoin is already sufficient to meet demand, which could put downward pressure on the price.

Moreover, the global economic situation is also playing a role in the potential dip in the Bitcoin price. With the ongoing COVID-19 pandemic, many countries are facing economic challenges, including high inflation and rising interest rates. These factors have led to a decrease in investor confidence, causing them to seek safer investments, such as gold or traditional stocks. As a result, the Bitcoin price may continue to fall as investors move away from riskier assets.

Despite the potential dip in the Bitcoin price, some experts remain optimistic about the long-term prospects of the cryptocurrency. They argue that Bitcoin's unique properties, such as its decentralized nature and limited supply, make it a valuable asset in the long run. Moreover, as more businesses and consumers adopt cryptocurrencies, the demand for Bitcoin is expected to increase, potentially driving the price higher.

For investors considering entering the Bitcoin market, it's crucial to understand the risks involved. The cryptocurrency market is unpredictable, and the potential for significant losses is always present. Before investing, it's essential to do thorough research and consider your risk tolerance.

In conclusion, the Bitcoin price may dip below $30,000 due to a combination of regulatory scrutiny, increasing supply, and global economic challenges. However, some experts remain optimistic about the long-term prospects of the cryptocurrency. As with any investment, it's crucial to do your homework and understand the risks involved before diving into the Bitcoin market.

Remember, the cryptocurrency market is highly volatile, and the Bitcoin price may continue to fluctuate. While the potential for significant gains exists, so does the risk of substantial losses. As always, proceed with caution and make informed decisions based on your own research and risk tolerance.

This article address:https://www.iutback.com/blog/32b3999928.html

Like!(6814)

Related Posts

- What is Bitcoin Cash App?

- How Do You Get a Wallet for Bitcoin?

- The Rise of the 3x Long Bitcoin Token on Binance: A Game-Changer for Crypto Investors

- Title: Prognose Binance Coin: The Future of Cryptocurrency

- Title: Enhancing Your Crypto Trading Strategy with the Binance Average Price Calculator

- What is the Point of Bitcoin Mining?

- **Revolutionizing Crypto Management with Paybis Crypto & Bitcoin Wallet

- Can I Convert Bitcoins into Cash?

- Ripple Bitcoin Share Price: A Comprehensive Analysis

- Best Bitcoin Wallet in Somalia: A Comprehensive Guide

Popular

Recent

The Benefits of Mining Bitcoin

Bitcoin Price Future 2019: A Look Back at the Cryptocurrency's Turbulent Journey

Best Free Bitcoin Mining App Android 2023: Your Ultimate Guide

Coinbase vs Binance Price: A Comprehensive Comparison

How to Buy Pundi X on Binance US: A Step-by-Step Guide

Mining Bitcoin Gold 2021: A Comprehensive Guide to the Gold Rush in the Cryptocurrency World

Bitcoin 48 Hour Prices: A Comprehensive Analysis

Best Free Bitcoin Mining App Android 2023: Your Ultimate Guide

links

- Tether Moves 80 Bitcoin Price Reddit: What You Need to Know

- The Rise of Metamask Phone App and Binance Smart Chain: A Game-Changer for Crypto Users

- The Rise of Spell Coin on Binance: A Cryptocurrency Revolution

- The Last Coins to Be Listed on Binance: A Look into the Future of Cryptocurrency Trading

- What Do You Get for Mining Bitcoin?

- Where Can I Buy and Send Bitcoins: A Comprehensive Guide

- Who is Mining the Most Bitcoin?

- Cathie Wood Price Prediction Bitcoin: What Does the Future Hold for the Cryptocurrency?

- Zengo: Crypto & Bitcoin Wallet – The Ultimate Solution for Secure Digital Asset Management

- What Was the First Price for Bitcoin: A Brief History of the Cryptocurrency's Early Days