You are here:iutback shop > markets

Bitcoin Prices Before and After Halving: A Comprehensive Analysis

iutback shop2024-09-20 23:29:16【markets】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized cryptocurrency, has been a topic of great interest since it airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized cryptocurrency, has been a topic of great interest since it

Bitcoin, the world's first decentralized cryptocurrency, has been a topic of great interest since its inception in 2009. One of the most significant events in the history of Bitcoin is the halving, which occurs approximately every four years. This event has a profound impact on Bitcoin prices, and in this article, we will explore the Bitcoin prices before and after halving.

Before we delve into the analysis, let's first understand what a halving is. A halving is a process in which the reward for mining a new Bitcoin block is halved. This event is designed to mimic the scarcity of precious metals like gold and silver. The reward for mining a block was initially 50 BTC, and it has been halved three times since then, with the latest halving occurring in May 2020.

The first halving took place in November 2012, reducing the block reward from 50 BTC to 25 BTC. Prior to this event, Bitcoin prices were relatively low, with the value of a single Bitcoin hovering around $12. However, after the halving, Bitcoin prices began to rise rapidly. By the end of 2013, the price of Bitcoin had surged to over $1,000, marking the first major bull run in the cryptocurrency's history.

The second halving occurred in July 2016, reducing the block reward from 25 BTC to 12.5 BTC. Similar to the first halving, Bitcoin prices experienced a significant increase after this event. In the months leading up to the halving, Bitcoin prices were around $400. However, after the halving, the price of Bitcoin skyrocketed to over $1,000, reaching an all-time high of $2,000 in December 2017.

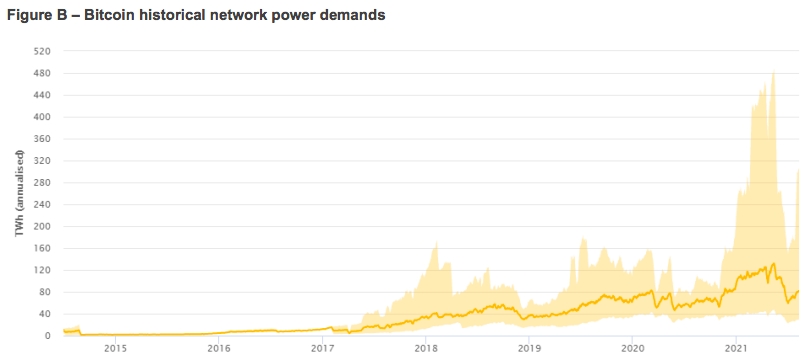

The third and most recent halving took place in May 2020, reducing the block reward from 12.5 BTC to 6.25 BTC. As with the previous halvings, Bitcoin prices began to rise in the months leading up to the event. In the first quarter of 2020, Bitcoin prices were around $8,000. However, after the halving, the price of Bitcoin surged to over $10,000, and it has continued to rise since then, reaching an all-time high of nearly $65,000 in April 2021.

So, what is the reason behind the increase in Bitcoin prices after each halving? The primary reason is the reduced supply of new Bitcoin. As the block reward is halved, the rate at which new Bitcoin is created decreases. This reduction in supply, combined with the growing demand for Bitcoin as a store of value and investment asset, leads to an increase in prices.

Moreover, the halving event has become a self-fulfilling prophecy. As investors and speculators anticipate the upcoming halving, they tend to buy Bitcoin, leading to an increase in prices. This behavior creates a positive feedback loop, where rising prices further fuel the anticipation of higher prices in the future.

In conclusion, Bitcoin prices before and after halving have shown a clear pattern of increasing. The halving event has a significant impact on the supply of new Bitcoin, which, in turn, affects its price. As the world continues to embrace cryptocurrencies, it is likely that the relationship between Bitcoin prices and halving events will remain a crucial factor in the cryptocurrency market.

This article address:https://www.iutback.com/blog/25a33199643.html

Like!(71)

Related Posts

- Binance BTC LTC: A Comprehensive Guide to Trading on Binance

- Blockchain Bitcoin Wallet Limit: Understanding the Cap and Its Implications

- The Ledger Nano S Bitcoin Wallet App: A Secure and User-Friendly Solution for Cryptocurrency Management

- Billfodle Bitcoin Wallet: A Secure and User-Friendly Cryptocurrency Solution

- Recovering a Bitcoin Wallet: A Step-by-Step Guide

- https://coinmarketcap.com/currencies/bitcoin-cash/ has become a significant topic of interest among cryptocurrency enthusiasts and investors alike. Bitcoin Cash, often abbreviated as BCH, is a cryptocurrency that emerged from a hard fork of Bitcoin in 2017. This article aims to delve into the origins, characteristics, and current status of Bitcoin Cash, as detailed on https://coinmarketcap.com/currencies/bitcoin-cash/.

- The Process of Mining Bitcoin: A Comprehensive Guide

- Trading Automatico Binance: Revolutionizing Cryptocurrency Trading

- Genesis Mining Bitcoin: A Comprehensive Guide to the Leading Cryptocurrency Mining Company

- Bitcoin Cash Chart Today: A Comprehensive Analysis

Popular

Recent

Can I Purchase Partial Bitcoins?

Get Bitcoin Cash After Fork: A Comprehensive Guide

The Rise of 7000 Bitcoin Binance: A Game-Changing Milestone in Cryptocurrency

Buy Bitcoin in Iraq with Cash: A Comprehensive Guide

Bitcoin Mining Rig with GPU: A Comprehensive Guide

Bitcoin Mining is Cancer: A Critical Analysis

How Can I Create My Bitcoin Wallet?

Bitcoin Mining USB Stick Kaufen: The Ultimate Guide to Choosing the Best USB Stick for Bitcoin Mining

links

- The third party Bitcoin wallet has become an essential tool for Bitcoin users around the world. As the popularity of cryptocurrencies continues to rise, more and more individuals are looking for secure and convenient ways to store their Bitcoin. In this article, we will discuss the benefits and features of third party Bitcoin wallets, and why they are becoming increasingly popular among Bitcoin users.

- What is the Cheapest Crypto on Binance?

- The Rise of Pi Network Coin on Binance: A New Era in Cryptocurrency Trading

- How to Sell Bitcoin for Cash on Binance: A Step-by-Step Guide

- Binance Price Prediction: The Future of Cryptocurrency Trading

- How to Send TRON from Binance to Coinbase: A Step-by-Step Guide

- Using Cash App for Bitcoin Trading: A Comprehensive Guide

- Trading Desde Cero en Binance: A Beginner's Guide to Cryptocurrency Trading

- Binance USDT Omni: A Comprehensive Guide to Understanding This Cryptocurrency

- How to Send Crypto to Binance: A Step-by-Step Guide