You are here:iutback shop > price

Cryptocurrency Prices on Binance: A Comprehensive Analysis

iutback shop2024-09-20 21:21:53【price】8people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the rapidly evolving world of digital currencies, Binance has emerged as a leading platform for t airdrop,dex,cex,markets,trade value chart,buy,In the rapidly evolving world of digital currencies, Binance has emerged as a leading platform for t

In the rapidly evolving world of digital currencies, Binance has emerged as a leading platform for trading cryptocurrencies. With its user-friendly interface and extensive range of trading pairs, Binance has become a go-to destination for both beginners and seasoned traders. This article aims to provide a comprehensive analysis of cryptocurrency prices on Binance, exploring the factors that influence these prices and the strategies traders can employ to navigate the volatile market.

Cryptocurrency prices on Binance are influenced by a multitude of factors. One of the primary drivers is the overall demand for digital currencies. As more individuals and institutions recognize the potential of cryptocurrencies, the demand for these assets tends to increase, leading to higher prices. Conversely, when there is a decrease in demand, prices may decline.

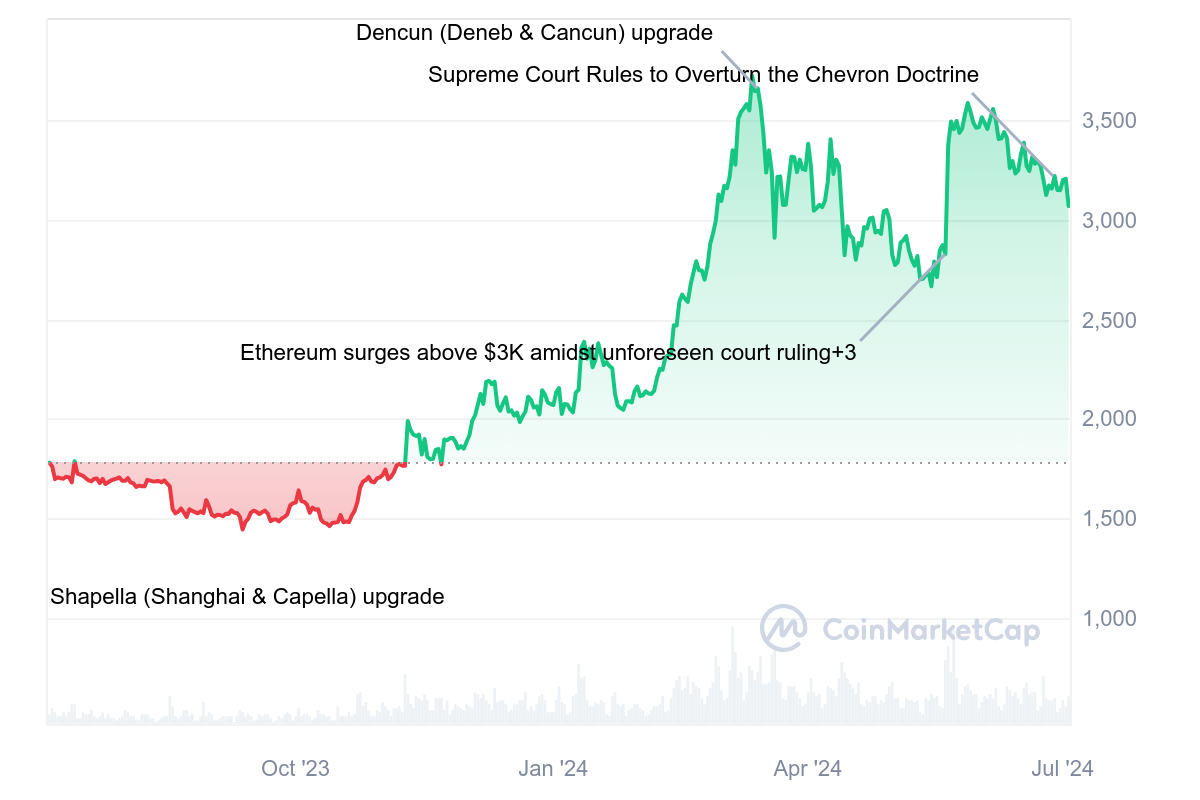

Market sentiment plays a crucial role in determining cryptocurrency prices on Binance. News and rumors about major developments in the cryptocurrency industry can cause prices to fluctuate dramatically. For instance, a positive announcement from a major cryptocurrency exchange or a regulatory decision from a government body can lead to a surge in prices. On the other hand, negative news or regulatory crackdowns can cause prices to plummet.

Another significant factor that affects cryptocurrency prices on Binance is the supply and demand dynamics. The supply of a particular cryptocurrency is often limited, which can create scarcity and drive up prices. For example, Bitcoin has a maximum supply of 21 million coins, which makes it a finite asset. This scarcity has contributed to its status as the leading cryptocurrency by market capitalization.

In addition to these factors, technological advancements and innovations can also impact cryptocurrency prices on Binance. For instance, the launch of a new blockchain platform or a significant upgrade to an existing one can attract investors and traders, leading to increased demand and higher prices.

Traders looking to capitalize on cryptocurrency prices on Binance can employ various strategies. One common approach is technical analysis, which involves studying historical price charts and patterns to predict future price movements. Traders use various indicators and tools, such as moving averages, volume, and Fibonacci retracement levels, to make informed decisions.

Another strategy is fundamental analysis, which involves evaluating the intrinsic value of a cryptocurrency based on its underlying technology, market adoption, and team. Traders who follow this approach often look for projects with strong community support, innovative technology, and a clear roadmap for future development.

Risk management is also a crucial aspect of trading cryptocurrency prices on Binance. Traders should be aware of their risk tolerance and set appropriate stop-loss and take-profit levels to mitigate potential losses. Diversification is another effective risk management strategy, as it involves spreading investments across different cryptocurrencies to reduce exposure to any single asset.

It is important to note that cryptocurrency prices on Binance can be highly volatile, and traders should be prepared for rapid price swings. Staying informed about the latest news and developments in the cryptocurrency market is essential for making well-informed trading decisions.

In conclusion, cryptocurrency prices on Binance are influenced by a complex interplay of factors, including market demand, sentiment, supply and demand dynamics, and technological advancements. Traders can employ various strategies, such as technical and fundamental analysis, to navigate the volatile market. However, it is crucial to approach trading with a well-defined risk management plan and stay informed about the latest market trends. As the cryptocurrency industry continues to grow, Binance remains a key platform for trading and monitoring cryptocurrency prices, providing traders with the tools and resources they need to succeed in this dynamic market.

This article address:https://www.iutback.com/blog/17b49399489.html

Like!(46865)

Related Posts

- Can You Buy Part of a Bitcoin on Robinhood?

- How to Withdraw from Circle Invest to Your Bitcoin Wallet

- Bitcoin Ethereum Price Chart: A Comprehensive Analysis

- Bitcoin Price Fall China: The Impact on the Cryptocurrency Market

- Buy with Litecoin on Binance: A Comprehensive Guide

- Bitcoin Mining on Amazon Cloud: A Game-Changing Approach

- Bitcoin Wallets for Chrome OS: A Comprehensive Guide

- Binance Lists YFI: A Game-Changing Move for the Cryptocurrency Market

- Is Bitcoin Mining a Lucrative Venture?

- Binance Mobile App Stop Loss: A Game-Changing Feature for Traders

Popular

Recent

Bitcoin Price from 2015 to 2020: A Comprehensive Analysis

The Rise of Bitcoin Cash Miner GPU: A Game Changer in Cryptocurrency Mining

The Current Status of Coingecko Bitcoin Cash INR

Rock Bitcoin Mining: The Trendy New Way to Mine Cryptocurrency

Can You Be a Millionaire with Bitcoin?

Bitcoin Mining on Amazon Cloud: A Game-Changing Approach

Bitcoin Wallet for PC and Android: A Comprehensive Guide

How Much Can Be Made Mining Bitcoin: A Comprehensive Guide

links

- List of Countries Supported by Binance: A Comprehensive Guide

- When is Bitcoin Cash Hardfork: Understanding the Upcoming Event

- Expected Price of Bitcoin in 2024: A Comprehensive Analysis

- How to Safely Withdraw Funds from Binance: A Comprehensive Guide

- Butcoin vs Bitcoin Cash: A Comprehensive Comparison

- Wearable Bitcoin Wallet: The Future of Cryptocurrency Convenience

- Ronnie Moas Bitcoin Cash: The Future of Cryptocurrency?

- **Instant Payout Bitcoin Cloud Mining Websites List Free

- What is Last Price in Binance?

- Butcoin vs Bitcoin Cash: A Comprehensive Comparison