You are here:iutback shop > bitcoin

Bitcoin 2018 Low Price: A Look Back at the Cryptocurrency's Turbulent Year

iutback shop2024-09-21 01:45:28【bitcoin】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the world of cryptocurrencies, Bitcoin has always been a prominent figure. However, 2018 was a ye airdrop,dex,cex,markets,trade value chart,buy,In the world of cryptocurrencies, Bitcoin has always been a prominent figure. However, 2018 was a ye

In the world of cryptocurrencies, Bitcoin has always been a prominent figure. However, 2018 was a year marked by significant volatility, with Bitcoin's price plummeting to its lowest level since early 2017. This article aims to delve into the factors that contributed to Bitcoin's 2018 low price and analyze its impact on the cryptocurrency market.

The year 2018 began with Bitcoin trading at around $17,000, a level that many investors considered to be unsustainable. However, the downward trend accelerated as the year progressed, with Bitcoin's price falling to a low of $3,200 in December 2018. This marked a staggering 81% decline from its all-time high in December 2017.

Several factors contributed to Bitcoin's 2018 low price. Firstly, regulatory concerns played a significant role. As governments around the world began to scrutinize cryptocurrencies more closely, investors grew increasingly wary of the market's stability. China, one of the largest Bitcoin mining hubs, announced a crackdown on cryptocurrency mining activities, which led to a decrease in the supply of Bitcoin and, consequently, a drop in its price.

Secondly, the bear market in traditional financial markets also had a negative impact on Bitcoin. As investors sought refuge in traditional assets, they pulled their capital out of cryptocurrencies, leading to a decrease in demand and, subsequently, a drop in prices. Additionally, the collapse of several high-profile Initial Coin Offerings (ICOs) raised concerns about the overall credibility of the cryptocurrency market, further dampening investor sentiment.

Another factor that contributed to Bitcoin's 2018 low price was the growing skepticism among investors regarding the long-term viability of cryptocurrencies. Many industry experts pointed to the lack of a clear regulatory framework and the high level of volatility as reasons to be cautious. This skepticism was further fueled by the numerous scams and fraudulent activities that plagued the cryptocurrency market during the year.

Despite the low price, Bitcoin's 2018 low price had a lasting impact on the cryptocurrency market. For one, it served as a wake-up call for regulators and investors alike, emphasizing the need for a more robust regulatory framework and a better understanding of the risks involved in investing in cryptocurrencies. Moreover, the low price prompted many investors to reevaluate their strategies and focus on the long-term potential of Bitcoin and other cryptocurrencies.

In the aftermath of the 2018 low price, Bitcoin has shown signs of recovery. The cryptocurrency has gained traction once again, with some analysts predicting a potential bull run in the near future. However, it is essential to remember that the market remains highly volatile, and investors should exercise caution when considering investments in cryptocurrencies.

In conclusion, Bitcoin's 2018 low price was a turbulent period for the cryptocurrency market. The factors that contributed to the decline in price, such as regulatory concerns, bear markets, and skepticism, have had a lasting impact on the industry. As Bitcoin and other cryptocurrencies continue to evolve, it is crucial for investors to remain vigilant and stay informed about the risks involved. Only then can they make informed decisions and navigate the ever-changing landscape of the cryptocurrency market.

This article address:https://www.iutback.com/blog/16b58399400.html

Like!(4779)

Related Posts

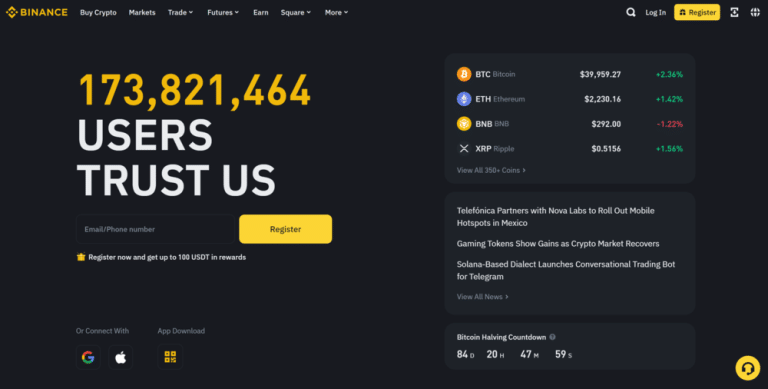

- Binance BTC Perpetual: A Game-Changing Trading Instrument for Cryptocurrency Investors

- Can I Buy Bitcoin in My Fidelity IRA?

- How to Get Coins Out of Binance: A Step-by-Step Guide

- The Rise of ICP Binance USDT: A Game-Changing Cryptocurrency Partnership

- Jaxx Can't Bitcoin Cash: The Controversy Unveiled

- Binance Withdraw to Mpesa: A Comprehensive Guide

- How to Change Bitcoin to Cash on Coinbase: A Step-by-Step Guide

- Michael Saylor Price Prediction Bitcoin: A Comprehensive Analysis

- How to Send BTC from Binance to Trust Wallet: A Step-by-Step Guide

- Title: Streamlining Your Crypto Journey: How to Transfer BTC to Binance

Popular

Recent

Step Coin Binance: A Comprehensive Guide to Understanding and Utilizing This Innovative Cryptocurrency Platform

The Dangers of Fake Bitcoin Mining Sites: A Cautionary Tale

Best Bitcoin to Cash Exchange: A Comprehensive Guide to Secure and Efficient Transactions

**Unlock the Potential of Mining Bitcoin Site Free: A Comprehensive Guide

Can Bitcoin Be Exchanged for US Dollars?

Can I Invest IRA Funds in Bitcoin?

Is Bitcoin the Same as Cash?

Can't Add Payment Method on Binance? Here's How to Fix It

links

- When Mining for Bitcoin Stops: The Future of Cryptocurrency

- Bitcoin Stock Price 2020: A Year of Volatility and Hope

- Title: Enhancing Bitcoin Security with Local Bitcoin Wallet iOS App

- Binance App on iPhone X: A Comprehensive Review

- **Swftcoin Binance Listing: A Milestone for the Cryptocurrency Community

- Bitcoin Price in Pakistan 2017: A Look Back at the Cryptocurrency's Journey

- Where to Get Bitcoin Cash Wallet: A Comprehensive Guide

- Binance App on iPhone X: A Comprehensive Review

- **Mining Bitcoin from Phone Service: A New Frontier in Cryptocurrency Mining

- Equinor Bitcoin Mining: The Norwegian Energy Giant's New Venture