You are here:iutback shop > block

When to Invest in Bitcoin Cash: A Strategic Approach

iutback shop2024-09-20 19:32:13【block】6people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, cryptocurrencies have gained significant attention from investors and enthusiasts a airdrop,dex,cex,markets,trade value chart,buy,In recent years, cryptocurrencies have gained significant attention from investors and enthusiasts a

In recent years, cryptocurrencies have gained significant attention from investors and enthusiasts alike. Among the various cryptocurrencies available, Bitcoin Cash (BCH) has emerged as a popular choice for many. However, determining the right time to invest in Bitcoin Cash can be a challenging task. This article aims to provide a strategic approach to help you decide when to invest in Bitcoin Cash.

Firstly, it is crucial to understand the factors that influence the price of Bitcoin Cash. Similar to other cryptocurrencies, the value of BCH is influenced by market sentiment, technological advancements, regulatory news, and macroeconomic factors. By analyzing these factors, you can make a more informed decision on when to invest in Bitcoin Cash.

1. Market Sentiment

Market sentiment plays a significant role in the price movement of cryptocurrencies. When the market is bullish, investors tend to be optimistic about the future of Bitcoin Cash, leading to an increase in demand and, consequently, an increase in price. Conversely, during bearish market conditions, investors may become skeptical, resulting in a decrease in demand and a drop in price.

To identify market sentiment, you can analyze various indicators, such as social media trends, news headlines, and trading volume. When sentiment is positive, it may be a good time to consider investing in Bitcoin Cash. However, it is essential to exercise caution and not solely rely on market sentiment, as it can be unpredictable.

2. Technological Advancements

The success of Bitcoin Cash largely depends on its underlying technology. As such, technological advancements can significantly impact its value. When considering investing in Bitcoin Cash, it is crucial to stay updated on any new developments, such as improved scalability, enhanced security, or increased adoption.

For instance, if a significant technological breakthrough is expected to be released in the near future, it may be a good time to invest in Bitcoin Cash. Conversely, if the technology is facing challenges or delays, it may be wise to wait for a more favorable opportunity.

3. Regulatory News

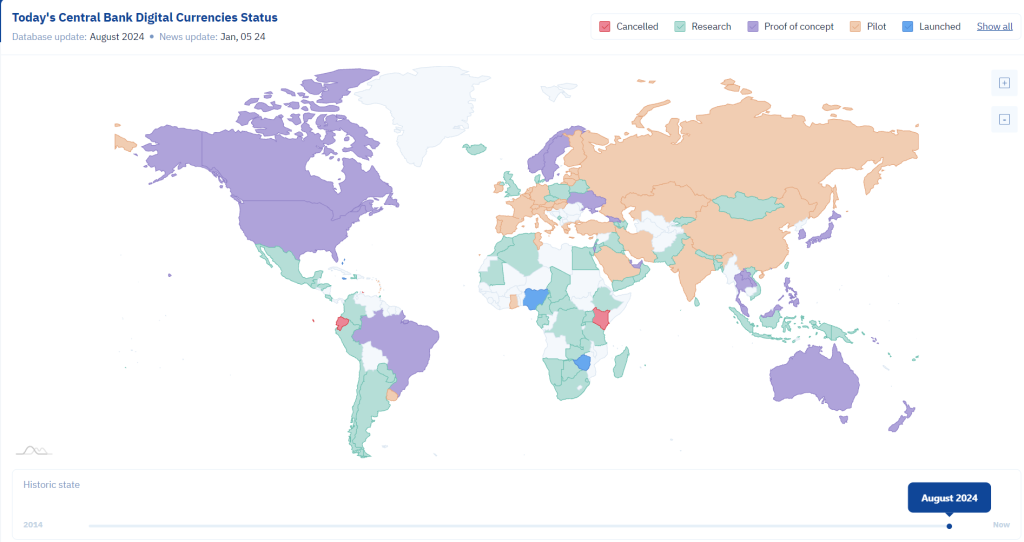

Regulatory news can have a significant impact on the price of Bitcoin Cash. Governments around the world are still figuring out how to regulate cryptocurrencies, and any news regarding regulatory changes can cause the market to react accordingly.

When considering investing in Bitcoin Cash, it is essential to stay informed about any regulatory news that may affect its value. For example, if a country is planning to adopt Bitcoin Cash as a legal tender, it may be a good time to invest. Conversely, if a country is considering banning cryptocurrencies, it may be wise to wait for a more favorable opportunity.

4. Macroeconomic Factors

Macroeconomic factors, such as inflation, interest rates, and economic stability, can also influence the price of Bitcoin Cash. When the economy is performing well, investors may be more inclined to invest in risky assets, such as cryptocurrencies. Conversely, during economic downturns, investors may seek safer investments, leading to a decrease in demand for Bitcoin Cash.

To determine when to invest in Bitcoin Cash based on macroeconomic factors, you can analyze economic indicators, such as GDP growth, inflation rates, and interest rates. When the economy is performing well, it may be a good time to consider investing in Bitcoin Cash.

In conclusion, deciding when to invest in Bitcoin Cash requires a strategic approach that considers market sentiment, technological advancements, regulatory news, and macroeconomic factors. By staying informed and analyzing these factors, you can make a more informed decision on when to invest in Bitcoin Cash. Remember that investing in cryptocurrencies involves risks, and it is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

This article address:https://www.iutback.com/blog/12e29899689.html

Like!(69654)

Related Posts

- Bitcoin Price Ruble: A Comprehensive Analysis

- Bitcoin Price Prediction January 2019: What to Expect

- Axie Infinity (AXS) Listed on Binance: A Game-Changing Move for the Crypto Community

- The Rise of Xeon Processor CPU Based Bitcoin Mining

- The Importance of Bitcoin Password Wallet: Safeguarding Your Cryptocurrency

- How to Buy Bitcoin Cash Cryptocurrency: A Comprehensive Guide

- Can an S Corp Own Bitcoin?

- Bitcoin Cash Twitter: The Hub for Cryptocurrency Conversations

- Bitcoin Price Insider: The Ultimate Guide to Understanding Bitcoin's Value

- Can I Send Bitcoin from Uphold?

Popular

Recent

Gigabyte Bitcoin Mining Motherboard: The Ultimate Choice for Aspiring Cryptocurrency Miners

Title: Troubleshooting: Can't Send Bitcoin from Coinbase Wallet to Coinbase

Best Free Bitcoin Wallet UK: Your Ultimate Guide to Secure and Convenient Cryptocurrency Storage

Is Cash App a Bitcoin Wallet?

NVIDIA Mining Bitcoin: A Game Changer in Cryptocurrency Mining

Solar-Powered Bitcoin Mining in California: A Sustainable Revolution

Converting Bitcoin Cash to USD: A Comprehensive Guide

Can I Send Bitcoin from Uphold?

links

- Binance Smart Chain Girl Moon: A Rising Star in the Blockchain Ecosystem

- Can You Buy Bitcoin in Texas?

- Sports Betting with Binance Coin: The Future of Online Gambling

- Title: Enhancing Bitcoin SV Transactions with the Wallet for Bitcoin SV Electron

- Can You Cash in Bitcoin for US Dollars?

- STM32 Bitcoin Mining: A Comprehensive Guide

- Binance Hardware Wallet Support: Ensuring Secure Cryptocurrency Storage

- What is Bitcoin Cash and Bitcoin Gold?

- www.bitcoinwalletlogin.com: A Comprehensive Guide to Secure Bitcoin Access

- Binance Withdrawal Fee IOTA: Understanding the Costs and Implications