You are here:iutback shop > trade

Bitcoin Fees vs Bitcoin Cash: A Comprehensive Analysis

iutback shop2024-09-20 23:24:02【trade】3people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the world of cryptocurrencies, Bitcoin and Bitcoin Cash have emerged as two of the most prominent airdrop,dex,cex,markets,trade value chart,buy,In the world of cryptocurrencies, Bitcoin and Bitcoin Cash have emerged as two of the most prominent

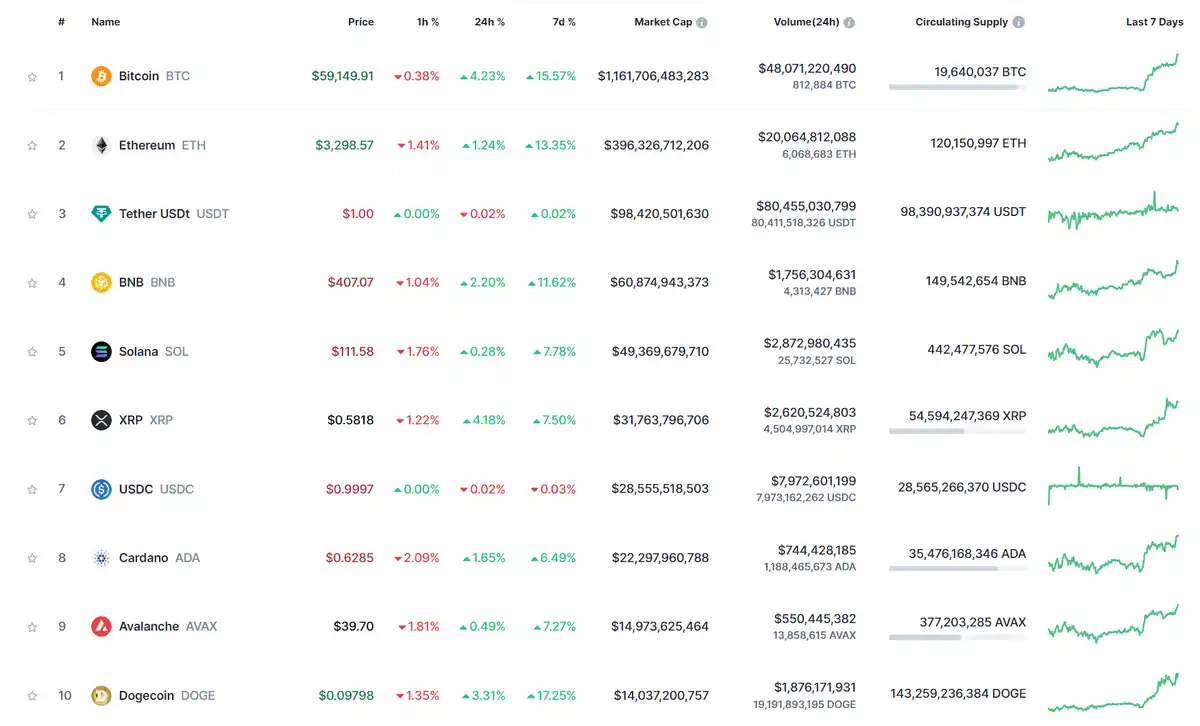

In the world of cryptocurrencies, Bitcoin and Bitcoin Cash have emerged as two of the most prominent digital currencies. While both share the same origin, they have diverged in their approach to transaction fees. This article aims to provide a comprehensive analysis of Bitcoin fees versus Bitcoin Cash fees, highlighting the differences and their implications for users.

Bitcoin Fees:

Bitcoin, launched in 2009, was the first decentralized cryptocurrency. It operates on a peer-to-peer network, where transactions are recorded in a public ledger called the blockchain. One of the key features of Bitcoin is its transaction fee system. These fees are paid by users to miners who validate and add transactions to the blockchain.

The Bitcoin network experiences varying levels of congestion, which directly impacts the transaction fees. During periods of high demand, such as when Bitcoin's price surges, fees can skyrocket. This is because miners prioritize transactions with higher fees, ensuring faster confirmation times. However, this has led to criticism regarding the fairness and accessibility of the network.

Bitcoin Cash Fees:

Bitcoin Cash, born from a hard fork of Bitcoin in 2017, aims to address some of the limitations faced by the original cryptocurrency. One of the primary goals of Bitcoin Cash is to reduce transaction fees. To achieve this, Bitcoin Cash increased the block size limit from 1 MB to 8 MB, allowing more transactions to be processed in a single block.

As a result, Bitcoin Cash fees are generally lower compared to Bitcoin. This is because the network can handle a higher volume of transactions without experiencing congestion. Additionally, Bitcoin Cash's simpler transaction fee structure makes it easier for users to estimate and pay the appropriate fees.

Bitcoin Fees vs Bitcoin Cash Fees:

Now, let's compare the two fee structures:

1. Transaction Volume: Bitcoin's network has a higher transaction volume due to its widespread adoption. However, Bitcoin Cash's larger block size allows it to handle a higher volume of transactions without congestion. This makes Bitcoin Cash a more scalable option for users who require frequent transactions.

2. Transaction Speed: Bitcoin's transaction confirmation time can vary, depending on the fee paid. During periods of high congestion, it can take several hours or even days for a transaction to be confirmed. In contrast, Bitcoin Cash offers faster confirmation times, typically within 10-15 minutes, even during peak times.

3. Accessibility: The high fees associated with Bitcoin during congestion can deter new users and small-scale transactions. Bitcoin Cash, with its lower fees, makes the network more accessible to a wider range of users, including those with limited financial resources.

4. Long-term Viability: The debate over Bitcoin fees has sparked discussions about the long-term viability of the network. Bitcoin Cash's focus on reducing fees and improving scalability positions it as a more sustainable option for the future.

In conclusion, Bitcoin fees versus Bitcoin Cash fees present a clear contrast in their approach to transaction costs. While Bitcoin's network has a higher transaction volume and faster confirmation times, its high fees during congestion can be a barrier for some users. Bitcoin Cash, on the other hand, offers lower fees and faster transactions, making it a more accessible and scalable option for the future. As the cryptocurrency landscape continues to evolve, the choice between Bitcoin and Bitcoin Cash will ultimately depend on the specific needs and preferences of users.

This article address:https://www.iutback.com/blog/10d25599734.html

Like!(821)

Related Posts

- Best Linux for Bitcoin Wallet: A Comprehensive Guide

- ### The Rise and Impact of Prix Bitcoin Cash

- Title: Exploring the World of Lit USDT on Binance

- Tweakers Bitcoin Wallet: A Secure and User-Friendly Cryptocurrency Solution

- Buying Kin via Binance: A Comprehensive Guide

- What is the Highest Price Bitcoin Can Reach?

- List NFT on Binance: A Comprehensive Guide to Navigating the World's Leading Cryptocurrency Exchange

- Why Can't I Find Shiba Inu on Binance?

- Binance Coin April 2021: A Look Back at the Month That Shaped the Crypto Landscape

- Title: Addressing the Problems Need to Solve for Bitcoin Mining

Popular

Recent

How to Hack Any Bitcoin Wallet: A Comprehensive Guide

Bitcoin Wallet Cash Out: A Comprehensive Guide to Withdrawing Your Cryptocurrency

Bitcoin Mining with Desktop PC: A Comprehensive Guide

Why Is Bitcoin Better Than Cash?

How Do You Get Listed on Binance?

Bitcoin Price Options Expire: Implications and Opportunities

hk bitcoin atm price: The Latest Trends and Considerations

Getting Bitcoin Cash from Electrum: A Step-by-Step Guide

links

- Bitcoin Paper Wallet Set Same Change Address: A Comprehensive Guide

- Title: Trust Wallet vs. Binance: A Comprehensive Comparison of Cryptocurrency Wallets

- The Squid Bitcoin Price: A Dive into the Cryptocurrency's Surging Market

- How to Get Bitcoin Price in Google Sheets

- What If Bitcoin Was This Price Calculator?

- Is It Possible to Track Someone Using a Bitcoin Wallet?

- What is Binance Smart Chain BEP20 Address?

- How to Check If a Website Is Mining Bitcoin

- Bitcoin Mining Software That Don't Require Fees: A Comprehensive Guide

- Bitcoin Gold Windows Wallet: A Comprehensive Guide to Securely Managing Your BTC Gold Holdings