You are here:iutback shop > markets

Ethereum vs Bitcoin Long Term Price: A Comprehensive Analysis

iutback shop2024-09-20 23:30:50【markets】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the world of cryptocurrencies, Bitcoin and Ethereum are two of the most prominent and influential airdrop,dex,cex,markets,trade value chart,buy,In the world of cryptocurrencies, Bitcoin and Ethereum are two of the most prominent and influential

In the world of cryptocurrencies, Bitcoin and Ethereum are two of the most prominent and influential digital assets. Both have their own unique features and advantages, making them popular among investors and enthusiasts. However, when it comes to long-term price performance, there is a heated debate about which one will ultimately reign supreme. This article aims to provide a comprehensive analysis of Ethereum vs Bitcoin long term price, considering various factors that might influence their future values.

Firstly, it is essential to understand the fundamental differences between Bitcoin and Ethereum. Bitcoin, launched in 2009, is the first and most well-known cryptocurrency. It operates on a decentralized network called the blockchain, which ensures secure and transparent transactions. Bitcoin has a fixed supply of 21 million coins, making it a deflationary asset. On the other hand, Ethereum, launched in 2015, is a blockchain platform that enables smart contracts and decentralized applications (DApps). It has a flexible supply and is designed to evolve over time.

One of the key factors that might influence the long-term price of Ethereum vs Bitcoin is their adoption rate. Bitcoin has been around for over a decade and has gained significant adoption among both retail and institutional investors. Its status as the "digital gold" has made it a safe haven asset during times of economic uncertainty. Ethereum, while relatively younger, has seen rapid growth in terms of DApp development and adoption. The increasing number of DApps and smart contracts on the Ethereum network has contributed to its rising demand and value.

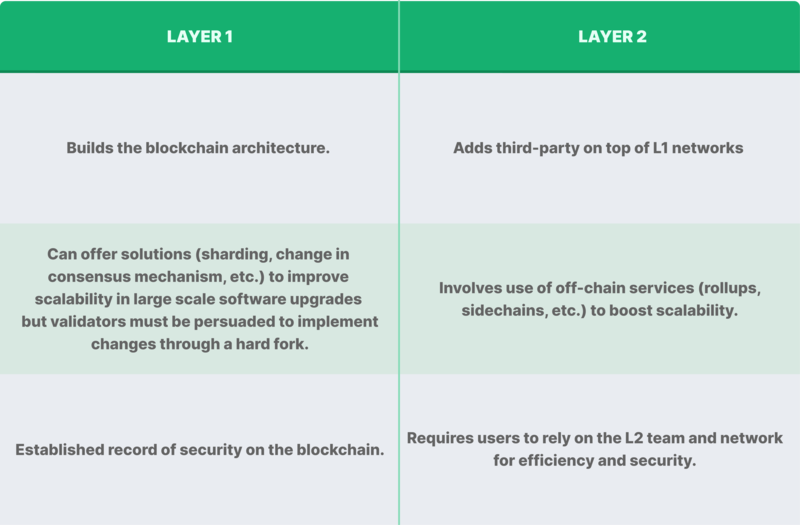

Another important factor to consider is the scalability issue. Bitcoin has faced scalability challenges, leading to slower transaction speeds and higher fees during peak times. This has raised concerns about its ability to handle a large number of transactions in the long run. In contrast, Ethereum has been working on solutions to improve its scalability, such as the upcoming Ethereum 2.0 upgrade. If Ethereum successfully addresses its scalability issues, it could attract more users and increase its long-term price potential.

Furthermore, regulatory factors play a crucial role in the long-term price of cryptocurrencies. Both Bitcoin and Ethereum have faced regulatory challenges in different regions, which can impact their adoption and value. While Bitcoin has faced regulatory scrutiny, it has also gained recognition as a legitimate asset in some countries. Ethereum, being a platform for DApps, has faced more complex regulatory challenges due to its diverse range of applications. However, as regulatory frameworks continue to evolve, both Bitcoin and Ethereum have the potential to adapt and thrive.

Lastly, technological advancements and innovation can significantly impact the long-term price of Ethereum vs Bitcoin. Bitcoin's core technology, blockchain, has been widely adopted and integrated into various industries. However, Ethereum's smart contract functionality has opened up new possibilities for decentralized applications, potentially revolutionizing industries such as finance, healthcare, and supply chain. If Ethereum continues to innovate and expand its ecosystem, it could attract more developers and users, driving up its long-term price.

In conclusion, the long-term price of Ethereum vs Bitcoin is influenced by various factors, including adoption rate, scalability, regulatory environment, and technological advancements. While Bitcoin has a strong foundation and widespread recognition, Ethereum's potential for innovation and expansion in the DApp space cannot be overlooked. As the cryptocurrency market continues to evolve, both Bitcoin and Ethereum have the potential to achieve significant long-term price growth. However, predicting the exact trajectory of their prices remains a challenging task, and investors should carefully consider their own risk tolerance and investment goals before making any decisions.

This article address:https://www.iutback.com/blog/07b57299420.html

Like!(27158)

Related Posts

- How to Buy Cryptocurrency with USD on Binance: A Step-by-Step Guide

- Zebpay Bitcoin Price Prediction 2018: A Look into the Future of Cryptocurrency

- Swap Boom on Binance Without BNB: A New Era of Crypto Trading

- Bitcoin Wallet Review 2016: A Comprehensive Look at the Top Cryptocurrency Wallets

- Binance USD Withdrawal: A Comprehensive Guide to Secure and Efficient Transactions

- Sell Bitcoin for Cash in Hong Kong: A Comprehensive Guide

- What is a Wallet Address Bitcoin?

- Title: How to Login into Your Bitcoin Wallet: A Step-by-Step Guide

- Bitcoin Price 2025 USD: A Comprehensive Analysis

- Title: How to Turn Cash into Bitcoin: A Comprehensive Guide

Popular

Recent

Bitcoin Mining Gaming Rig: A Game-Changing Combination

Binance Future BTC: A Comprehensive Guide to Trading Bitcoin on Binance's Platform

Best Bitcoin Wallet in Colombia: A Comprehensive Guide

**Use My Hard Disk for Bitcoin Wallet: A Secure and Efficient Solution

How to Trade Cryptocurrency with Binance: A Comprehensive Guide

Mining Contracts for Bitcoin: A Comprehensive Guide to Secure and Profitable Investment

**Metamask Binance Smart Chain: A Comprehensive Guide to Enhanced Blockchain Experience

Why Use BNB on Binance: The Ultimate Guide

links

- Where Should I Move My Binance Crypto?

- Binance Minimum Trade USDT: Everything You Need to Know

- Understanding Binance App: A Comprehensive Guide

- BTT/BTC Binance: The Future of Cryptocurrency Trading

- Spencer Bogart Bitcoin Price: A Comprehensive Analysis

- Title: How to Transfer Bitcoin Wallet to Multibit: A Step-by-Step Guide

- Bitcoin Cash Drop: A Revolutionary Concept for the Future of Cryptocurrency

- Binance US App Safe: Ensuring Secure Trading on the Go

- How to Store Bitcoin When Mining

- What Are the Bitcoin Wallets?