You are here:iutback shop > news

Bitcoin Price Hits 52-Week High: What Does It Mean for Investors?

iutback shop2024-09-20 23:28:11【news】6people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The cryptocurrency market has been experiencing a remarkable rally in recent months, and Bitcoin, th airdrop,dex,cex,markets,trade value chart,buy,The cryptocurrency market has been experiencing a remarkable rally in recent months, and Bitcoin, th

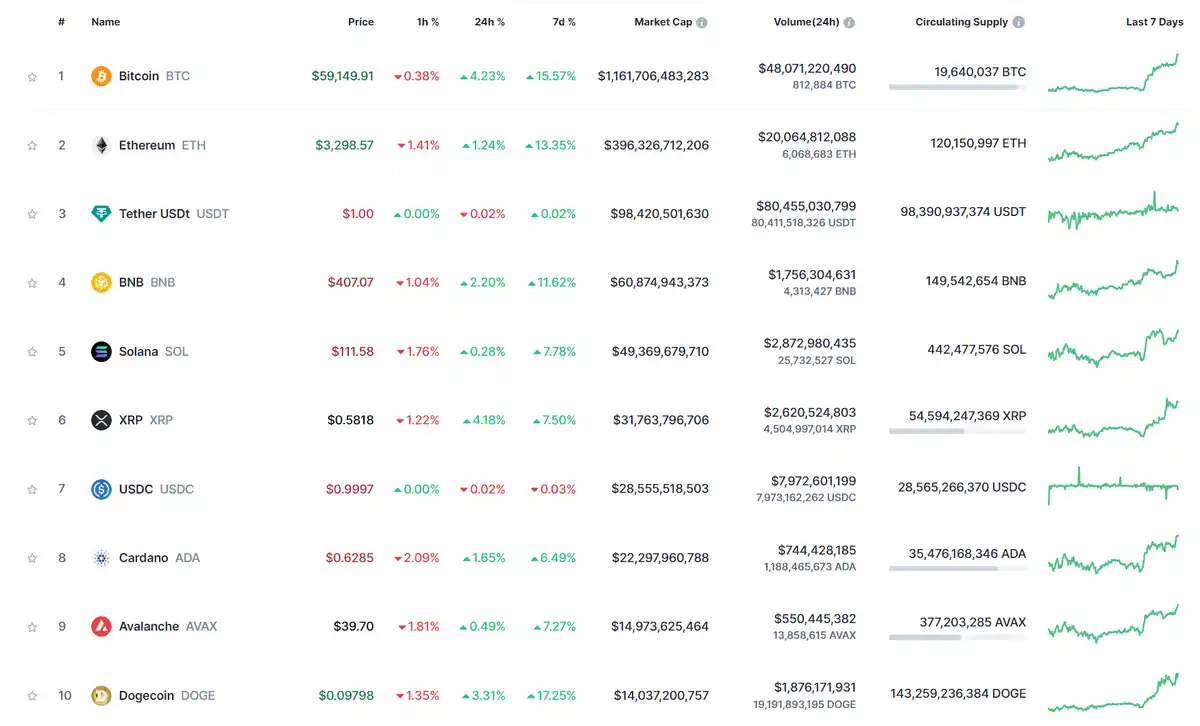

The cryptocurrency market has been experiencing a remarkable rally in recent months, and Bitcoin, the world's largest cryptocurrency by market capitalization, has been leading the charge. The latest milestone for Bitcoin is that it has reached a 52-week high, marking a significant achievement for the digital currency. In this article, we will discuss the implications of this development and what it means for investors.

Firstly, let's understand what a 52-week high means. A 52-week high refers to the highest price a stock, commodity, or cryptocurrency has reached within the past 52 weeks, which is approximately one year. When Bitcoin hits a 52-week high, it indicates that the price has surged significantly over the past year, showcasing the strong performance of the cryptocurrency.

The recent surge in Bitcoin's price can be attributed to several factors. One of the primary reasons is the increasing institutional interest in cryptocurrencies. Many institutional investors, including hedge funds and pension funds, have started to allocate a portion of their portfolios to digital assets. This has led to a substantial increase in demand for Bitcoin, pushing its price higher.

Another factor contributing to Bitcoin's 52-week high is the growing acceptance of cryptocurrencies as a legitimate asset class. Governments and financial institutions around the world are increasingly acknowledging the potential of cryptocurrencies and are exploring ways to integrate them into the existing financial system. This acceptance has led to a surge in interest from retail investors, further driving up the price of Bitcoin.

Moreover, Bitcoin's halving event, which occurred in May 2020, has also played a crucial role in the cryptocurrency's recent rally. The halving event reduces the reward for mining new Bitcoin blocks by half, making it more challenging and expensive to produce new coins. This scarcity has increased the perceived value of Bitcoin, as investors believe that the supply of new coins will decrease over time.

For investors, reaching a 52-week high is a significant development. It indicates that Bitcoin has the potential to continue its upward trend, making it an attractive investment opportunity. However, it is important to note that investing in cryptocurrencies involves risks, and investors should conduct thorough research before making any investment decisions.

One of the advantages of investing in Bitcoin during its 52-week high is the potential for significant returns. As the cryptocurrency continues to gain mainstream acceptance and adoption, its value is likely to appreciate further. However, it is essential to keep in mind that the market is highly volatile, and prices can fluctuate rapidly.

Another aspect to consider is the correlation between Bitcoin and traditional financial markets. In recent years, Bitcoin has shown a strong correlation with stock markets, particularly during times of economic uncertainty. This correlation suggests that Bitcoin can serve as a hedge against traditional investments, providing diversification to an investment portfolio.

In conclusion, Bitcoin's 52-week high is a testament to the growing acceptance and demand for the cryptocurrency. While it presents a promising investment opportunity, investors should be aware of the risks involved and conduct thorough research before investing. As the digital currency continues to gain traction, it is likely that its price will remain strong, making it an intriguing asset for investors to consider.

This article address:https://www.iutback.com/blog/03e27199725.html

Like!(8)

Related Posts

- How to Buy TRX Tron on Binance: A Step-by-Step Guide

- Bitcoin Quick Price: A Comprehensive Guide to Understanding the Volatile Cryptocurrency Market

- How to Withdraw from Binance: A Step-by-Step Guide

- Australian Bitcoin Wallet Reviews: A Comprehensive Guide to Secure and User-Friendly Options

- How Many Bitcoin Cash Are Left: The Current Status and Future Outlook

- How to Buy Saitama on Binance: A Step-by-Step Guide

- Bitcoin Wallet with Low Fees: The Ultimate Guide to Cost-Effective Cryptocurrency Management

- The Current Value of Bitcoin Cash: A Comprehensive Analysis

- How is Mining Bitcoin Reported?

- Bitcoin Cash Hard Fork January: A Look Back at the Controversial Split

Popular

Recent

Does Ethereum Price Follow Bitcoin?

How to Connect Your Binance to Trust Wallet: A Step-by-Step Guide

Bitcoin Price Chart 2019: A Comprehensive Analysis

Faucet Bitcoin Wallet: A Game-Changing Tool for Cryptocurrency Beginners

Can You Buy Fractional Shares on Binance?

Bitcoin Cash BCC Rate: The Current Status and Future Prospects

Why Bitcoin Drop in Price: Understanding the Factors Behind the Cryptocurrency's Decline

How to Withdraw Bitcoin from Coinbase to Your Wallet: A Step-by-Step Guide

links

- Transfer Bitcoin to USD on Binance Then Transfer to Coinbase: A Step-by-Step Guide

- Bitcoin Cash vs Bitcoin Wallet: Understanding the Difference

- Bitcoin Mining Sticks: A Compact and Efficient Solution for Cryptocurrency Mining

- Title: Waar Bitcoin Cash Kopen: A Comprehensive Guide

- Bitcoin Ripple Price INR: A Comprehensive Analysis

- Binance Withdrawal Label: A Comprehensive Guide to Secure Transactions

- Binance Chain BSC: The Future of Decentralized Finance

- Tom Lee Bitcoin Cash: A Game-Changing Cryptocurrency

- Bitcoin Airdrop Binance: A Lucrative Opportunity for Crypto Enthusiasts

- Title: How to Download and Use the Ledger Wallet Bitcoin Chrome App